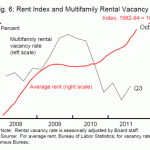

With interest rates at all time lows why wouldn’t banks love handing out home equity lines of credit (HELOC)? Since HELOCs are all written as adjustable rate second mortgages any increase in interest rates translates into instantly higher profits for banks. With a HELOC the borrower takes on interest rate risk as opposed to a […]

The FDIC Will Eliminate Deposit Insurance On $1.4 Trillion Of Bank Deposits

In the aftermath of the banking meltdown that began in 2008 many large depositors with balances in excess of the standard deposit insurance limit of $250,000 became very concerned about losing money in a bank failure. In an effort to instill confidence in the banking system, the Dodd-Frank Act instituted temporary unlimited deposit insurance on […]

Ridiculous Divergence Between Bank CEO Pay And Shareholder Returns

The wide divergence between bank CEO compensation and shareholder returns is an embarrassment to the capitalist notion of linkage between performance and pay. Shareholders of banking stocks have seen the value of their investments pulverized over the past four years as the banking industry struggles to recover from the lending excesses of previous years. Shareholders […]

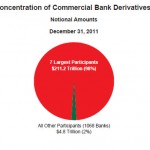

Banks Amass $211 Trillion In Derivatives, JP Morgan Loses $2 Billion And Volcher Rule Debates Continue

The goal of the Volcker Rule, which became law under the Dodd-Frank Act was to restrict speculative trading activity in risky derivatives by the Too Big To Fail Banks. The ban on proprietary bank trading was proposed by former Federal Reserve Chairman Paul Volcker who believed that one of the primary causes of the 2008 […]

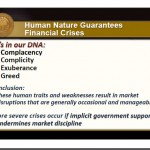

Dallas Fed Says “Too Big To Fail Banks” Should Be Broken Up – Future “Severe Crises” Possible

The Federal Reserve Bank of Dallas joined the growing chorus of critics who maintain that the Dodd-Frank Act will not prevent future taxpayer funded bank bailouts. The Dallas Fed said taxpayers are still at risk for the cost of large banks failures and that any future bailouts should result in severe consequences for both bank […]

Bank of the Eastern Shore, Cambridge, MD, Fails – Uninsured Depositors Out Of Luck As FDIC Fails To Find Buyer

Maryland state regulators closed the Bank of the Eastern Shore, Cambridge, MD and the FDIC was appointed as receiver. As has happened on previous occasions, the FDIC was unable to find a buyer for the failed bank, leaving uninsured depositors at risk of loss on their savings. To protect insured depositors and wind down the […]

Exponential Increase In Lending Regulations Impede Bank Lending, Provide Lifetime Employment To Government Regulators

Has the exponential increase in lending regulations since 2008 contributed to the worst economic decline since the Depression of the 1930’s? Government “solutions” to problems have a long history of failure. In addition, the unanticipated consequences of government “solutions” often result in a plethora of new problems worse than the original ones the government was […]

Banks Tell 30 Million Troubled Customers To Get Lost – One In Three Consumers Now “Unbanked”

How does the average consumer get by without a basic checking account? How does someone without a checking account pay the bills that arrive each month – drive around to each creditor and pay in cash? Where do you keep your savings – under the mattress or buried in the back yard? As incredible as […]

Banking News – Daily Banking Update

Welcome to Banking Update, a roundup of articles and news from around the Internet. Banks continue to be sued for selling defective mortgages, the Fed says a housing recovery is essential for economic recovery, Americans still believe owning a home is part of the “American dream”, banks are still engaged in risky behavior, savings rates […]