The latest FDIC Quarterly Banking Profile for the quarter ending September 30, 2014 shows a strong increase in both profits and revenues as the recovery in the banking industry continues. Banking industry profits rose to $38.7 billion during the third quarter, up by $2.6 billion or 7.3 percent from $36.1 billion in the comparable prior […]

Banking Industry Profits and Revenues Show Strong Increase in 2014 Third Quarter

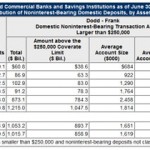

The FDIC Will Eliminate Deposit Insurance On $1.4 Trillion Of Bank Deposits

In the aftermath of the banking meltdown that began in 2008 many large depositors with balances in excess of the standard deposit insurance limit of $250,000 became very concerned about losing money in a bank failure. In an effort to instill confidence in the banking system, the Dodd-Frank Act instituted temporary unlimited deposit insurance on […]

Fee Hungry Banks Charge “FDIC Fees” To Depositors

It’s not easy being a banker. For example, how do you make up lost revenue from reduced loan demand? In the aftermath of the financial crisis of 2008, banks have been struggling to increase revenues as loan growth remains anemic. For the quarter ending March 31, 2012, total loan and lease balances of all FDIC […]

Higher Bank Profits Driven By Lower Loan Loss Provisions – Core Lending Business Declines

The earnings “recovery” in the banking industry continues to be driven by reduced loan loss provisions and higher fees rather than a fundamental improvement in the core lending business. The FDIC’s Quarterly Banking Profile for the first quarter of 2012 reports that aggregate quarterly profits of commercial banks and savings institutions increased for the 11th […]

Bank of the Eastern Shore, Cambridge, MD, Fails – Uninsured Depositors Out Of Luck As FDIC Fails To Find Buyer

Maryland state regulators closed the Bank of the Eastern Shore, Cambridge, MD and the FDIC was appointed as receiver. As has happened on previous occasions, the FDIC was unable to find a buyer for the failed bank, leaving uninsured depositors at risk of loss on their savings. To protect insured depositors and wind down the […]

Home Savings of America Collapses, FDIC Unable To Sell Bank – How Much Will Depositors Lose?

Home Savings of America, which was established during the depths of the Great Depression, was closed by regulators today. The Bank was established on September 1, 1934 and operated as a federally chartered stock savings and loan association, headquartered in Little Falls, Minnesota. According to Home Savings of America’s website, the Bank’s niche was serving […]

FDIC Forecasts $19 Billion In Losses On Banking Failures – Why The Losses Will Be Five Times Larger

The FDIC today released an update on expected losses for banking failures through 2015. For the five year period 2011 through 2015 the FDIC is forecasting total losses from banking failures of $19 billion. Total losses from banking failures during 2010 were $23 billion compared to $6.4 billion in 2011 year to date losses. A […]

$1.2 Trillion Of Nervous Money Floods Into U.S. Banking System

With the European banking system tottering on the brink of collapse, nervous holders of cash have flooded the U.S. banking system with $1.2 trillion of deposits. Panicky holders of large amounts of cash are taking advantage of a provision of the Dodd-Frank Act that provides unlimited FDIC insurance coverage on noninterest-bearing transaction accounts. The Dodd-Frank […]

FDIC Quarterly Banking Profile Shows Increase In Problem Banks

The latest FDIC Quarterly Banking Profile (QBP) shows another increase in the number of problem banks. The mortgage and debt crisis that began in 2007, along with continued weakness in the economy has resulted in a huge increase in the number of problem banks. In 2007, the FDIC had a total of 76 institutions on […]

FDIC 2010 Third Quarter Banking Profile

Today, the FDIC released its latest quarterly banking profile, which highlighted an increase in earnings for FDIC-insured institutions. For the third quarter of 2010, commercial banks and savings institutions insured by the FDIC reported aggregate profits of $14.5 billion compared to only $2 billion in the year ago period. However, the results did represent a […]