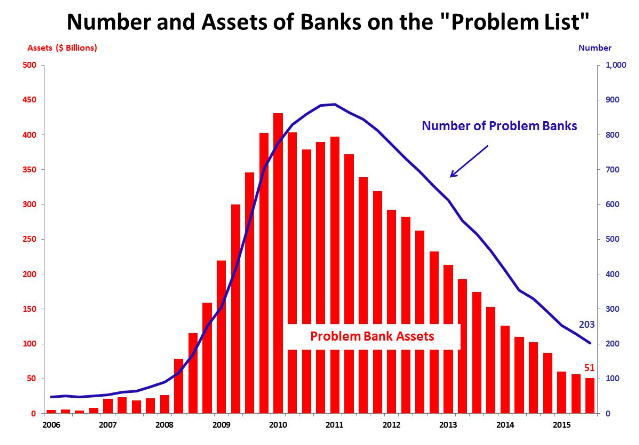

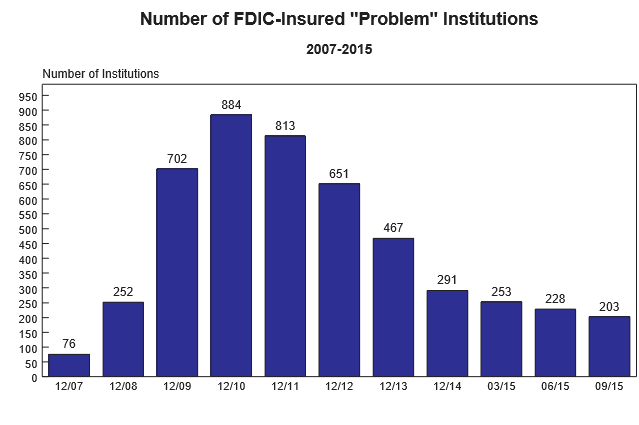

The number of banks on the FDIC Problem Bank List continues its steady decline since peaking at 888 banks in March 2011. According to the latest FDIC Quarterly Banking Profile the number of problem banks stood at 203 as of September 30, 2015, down by 25 banks since the previous quarter. The number of problem banks declined by 88 banks or 30.2 percent from last year’s total of 291 banks on December 31, 2014.

All but one of the 25 banks that fell off of the Problem Bank List during the quarter ending September 30, 2015 were either acquired, able to obtain or grow additional capital, or purchased by another institution. The only failure of an FDIC insured institution during the quarter ending September 30, 2015 occurred on July 11, 2015 when Premier Bank, a small Denver, CO, institution was closed by regulators.

The number of problem banks has declined significantly since the financial crisis due to improved asset quality, growth of loan portfolios, more stringent lending standards, improvement in commercial and residential market values, and a slowly improving economy.

The number of problem banks has declined by over 77 percent since reaching a peak during early 2011.

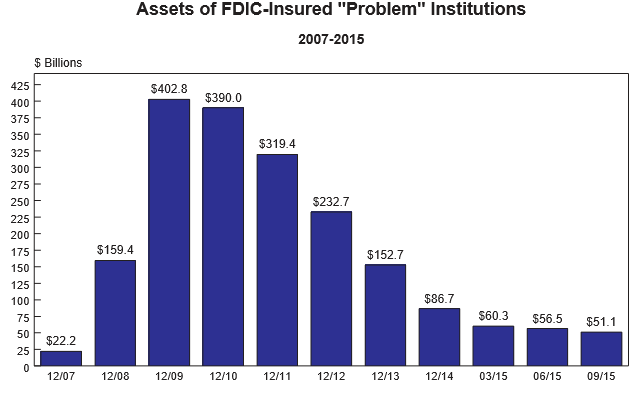

The amount of assets held by problem banks has closely tracked the decline in the number of problem banks. As of September 30, 2015, Problem Bank assets totaled $51.1 billion, a huge decline from almost half a trillion dollars at the end of 2009.

While $51 billion in troubled assets is insignificant in terms of the total assets held by all FDIC insured institutions, it still remains a source of concern. Consider that almost a decade after the advent of the financial crisis over 200 banks remain capital impaired and subject to possible failure. Some of these problem banks may be of considerable size. A simple calculation shows that the average problem bank has about a quarter of a billion dollars in total assets.

While $51 billion in troubled assets is insignificant in terms of the total assets held by all FDIC insured institutions, it still remains a source of concern. Consider that almost a decade after the advent of the financial crisis over 200 banks remain capital impaired and subject to possible failure. Some of these problem banks may be of considerable size. A simple calculation shows that the average problem bank has about a quarter of a billion dollars in total assets.

Speak Your Mind

You must be logged in to post a comment.