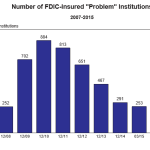

The number of banks on the FDIC Problem Bank List continues its steady decline since peaking at 888 banks in March 2011. According to the latest FDIC Quarterly Banking Profile the number of problem banks stood at 203 as of September 30, 2015, down by 25 banks since the previous quarter. The number of problem […]

Number of Problem Banks Declines for 15th Consecutive Quarter

According to the latest FDIC Quarterly Banking Profile the number of problem banks continued to decline for the quarter ending December 31, 2014. After reaching a peak of 888 at the end of the first quarter of 2011 the number of problem banks has declined for 15 consecutive quarters. The number of problem banks is […]

Banks Have Just Lost Their Biggest Profit Center – What Will Replace Billions of Profits from Loan-Loss Releases?

During the past five years bankers have reaped billions of dollars in profits by simply making accounting entries instead of making loans. What was the biggest source of banking industry profit growth over the past five years? As noted repeatedly in FDIC Quarterly Banking Profile reports, the biggest contribution to earnings growth has come from […]

Over 8,500 Banks Have Disappeared Since 1990 – “Too Big to Fail” Remains a Banking Reality

The latest FDIC Quarterly Banking Profile highlights the sharp decline in the number of banks over the past 24 years. For the quarter ending September 30, 2014 the number of FDIC insured institutions totaled 6,589 down by 56 percent from a total of 15,158 in 1990. Since December 1998 the number of banks has dropped […]

Banking Industry Profits and Revenues Show Strong Increase in 2014 Third Quarter

The latest FDIC Quarterly Banking Profile for the quarter ending September 30, 2014 shows a strong increase in both profits and revenues as the recovery in the banking industry continues. Banking industry profits rose to $38.7 billion during the third quarter, up by $2.6 billion or 7.3 percent from $36.1 billion in the comparable prior […]

Five Years After the Banking Crisis, Hundreds of Problem Banks Still Struggle

While many banks have completely recovered from the banking and financial crises of over six years ago, the number of banks classified as “Problem Banks” by the FDIC has remained stubbornly high. A milestone of sorts was reached recently when, after five years, the number of banks on the FDIC’s Problem Bank List finally declined […]

FDIC Reveals That Over 400 Banks Remain on the Problem Bank List

The recently released Quarterly Banking Profile from the FDIC reveals that over 400 banks remain on the Problem Bank List more than six years after the start of the biggest banking crisis since the 1930s. As of March 31, 2014, the FDIC’s confidential Problem Bank List contains the names of 411 banking institutions that have […]

Banking Industry Profits Decline On Plunge in Mortgage Demand

The banking industry has made a dramatic recovery since the depths of the financial crisis when many of the country’s biggest banks survived only after receiving trillions of dollars in government support. After losing a record $37.8 billion during the fourth quarter of 2008, banking industry profits rebounded to a record high of $40.3 billion […]

Increased Bank Profits Mainly Due to Lower Loan Loss Provisions – When Will Real Profits Increase?

On the surface the latest FDIC Quarterly Banking Profile reflects a recovering banking industry with robust profit growth. For the fourth quarter of 2013 banks collectively reported net income of $40.3 billion which is a $5.8 billion or 16.9% increase from the previous year’s fourth quarter. Making the picture look even brighter is the fact […]

FDIC Says Problem Banks Still Six Times Higher Than in 2007

The FDIC Quarterly Banking Profile for the fourth quarter of 2013 shows a continued reduction in the number of problem banks. The total number of banks on the FDIC Problem Bank List decreased for the 11th consecutive quarter to 467 banks as of December 31, 2013 compared to 515 problem banks in the previous quarter. […]