A very large bank failure occurred today when state regulators closed First NBC Bank, New Orleans, and appointed the FDIC as receiver. To prevent losses to depositors, the FDIC took a significant hit to its Deposit Insurance Fund and sold First NBC Bank to Whitney Bank, Gulfport, Mississippi. In terms of asset size the collapse of […]

Five Billion Dollar Bank Failure – First NBC Bank, New Orleans, Closed by Regulators

Allied Bank, Mulberry, AK, Becomes Fifth Bank Failure of 2016

It’s been six years since a bank failed in the state of Arkansas but this trend ended on Friday when state regulators closed Allied Bank in Mulberry, Arkansas. The failure of Allied Bank apparently had no linkage to the health of the overall business environment in Arkansas. According to the Arkansas Banking Commissioner, Candace Franks, “This […]

The Woodbury Banking Company Closed by Regulators

The Woodbury Banking Company, a tiny bank located in Woodbury, Georgia, was closed today by Georgia state regulators. The FDIC, appointed as receiver, sold the bank to United Bank, Zebulon, Georgia, in order to protect depositors of the failed bank. Founded over a hundred years ago in 1902 The Woodbury Banking Company remained a very […]

First Cornerstone Bank, King of Prussia, PA – Largest Bank Failure of 2016

The largest banking failure of the year occurred when state regulators closed the First Cornerstone Bank, King of Prussia, PA. In order to protect depositors, the FDIC in its role as receiver, entered into a purchase and assumption agreement with First-Citizens Bank & Trust Company, Raleigh, North Carolina. First Cornerstone Bank was established in March […]

Trust Company Bank, Memphis, TN, Closed by Regulators

Trust Company Bank, Memphis, Tennessee, was closed by state regulators who appointed the FDIC as receiver. In order to protect depositors the FDIC sold the failed bank to The Bank of Fayette County, Piperton, Tennessee. Trust Company Bank is the second banking failure of the year. The last banking failure of 2016 occurred on […]

North Milwaukee State Bank, WI, First Bank Failure of 2016

The first bank failure of 2016 occurred today when regulators closed a small bank in Wisconsin. It has been almost six months since the last banking failure in the U.S. The last FDIC insured bank failure occurred on October 2, 2015 when regulators closed Hometown National Bank, Longview, WA. North Milwaukee State Bank, Milwaukee, Wisconsin, […]

Hometown National Bank, Longview, WA, Closed by Regulators

After almost three months since the last bank closing regulators closed two banks on the first Friday of October. The first bank failure occurred when The Bank of Georgia, Peachtree, GA, was closed, followed shortly thereafter by the failure of the Hometown National Bank, Longview, Washington. In order to protect depositors the FDIC sold the failed Hometown National […]

The Bank of Georgia Closed By Regulators – 7th Bank Failure of 2015

After almost a three month hiatus of bank failures, regulators closed The Bank of Georgia, Peachtree City, Georgia. Fulfilling one of its primary roles as guarantor of depositor funds, the FDIC sold the failed bank to Fidelity Bank, Atlanta, GA, which will assume all of the deposits of The Bank of Georgia. Established in February 2000 by […]

Premier Bank, Denver, CO, Becomes Sixth Bank Failure of 2015

After a hiatus of two months the sixth banking failure of 2015 occurred today when regulators closed Premier Bank, Denver, CO. The last banking failure occurred on May 8th when Edgebrook Bank, Chicago, IL, was closed. After being shut down by the Colorado Division of Banking, the FDIC was appointed as receiver and sold the […]

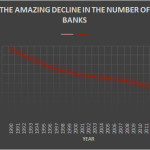

The Amazing Decline in the Number of Banks Has Resulted in Big Bank Domination

The number of banks operating in the United States has been in an amazing decline for the past 25 years. Many institutions disappeared after going bust during the savings and loan crisis of the early 1990’s while hundreds more collapsed during the financial panic and banking crisis that started in 2008. Since 2008 a total […]