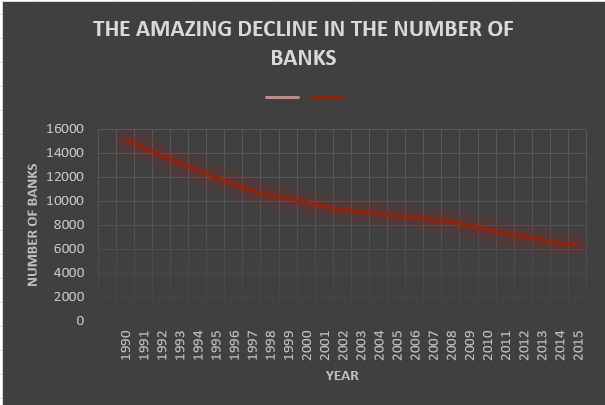

The number of banks operating in the United States has been in an amazing decline for the past 25 years. Many institutions disappeared after going bust during the savings and loan crisis of the early 1990’s while hundreds more collapsed during the financial panic and banking crisis that started in 2008.

Since 2008 a total of 512 banks failed and were closed by banking regulators. Even today, seven years after the start of the financial crisis, their are still 253 banks classified as “problem banks” by the FDIC due to their poor financial condition. Many of these problem banks will probably wind up failing which will reduce the head count of banks ever further.

Banking Failures Since 2008

Year Number of Bank Failures

2008 25

2009 140

2010 157

2011 92

2012 51

2013 24

2014 18

2015 5

Total 512

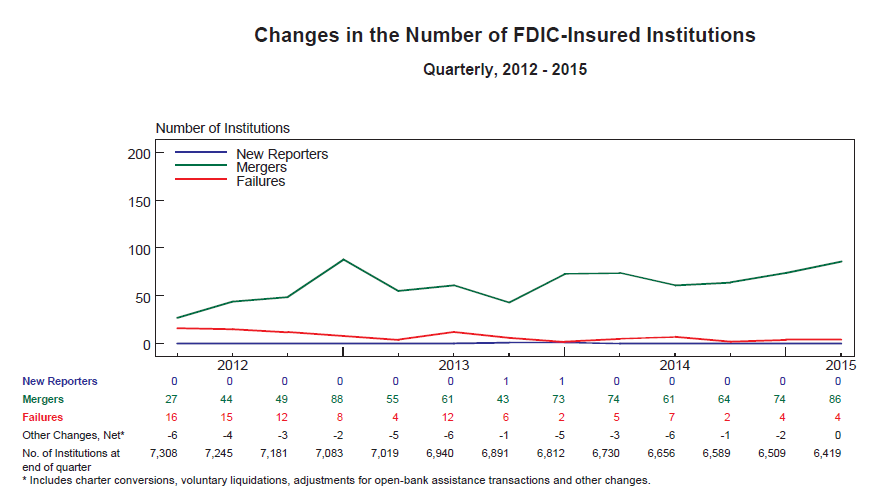

Thousands of banks have also disappeared over the years after being swallowed up by big banks. With tougher financial regulations in the wake of the financial crisis and the passage of the Dodd-Frank Act, many smaller banks simply cannot compete or afford to implement costly new financial regulations.

Another factor contributing to the decline in the number of banks is a total collapse in the formation of new banks. Prior to the banking and housing crisis, hundred of new banks were started each year. By comparison there were exactly two new banks that opened for business since 2012.

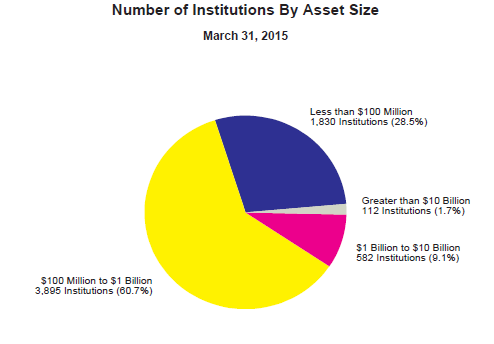

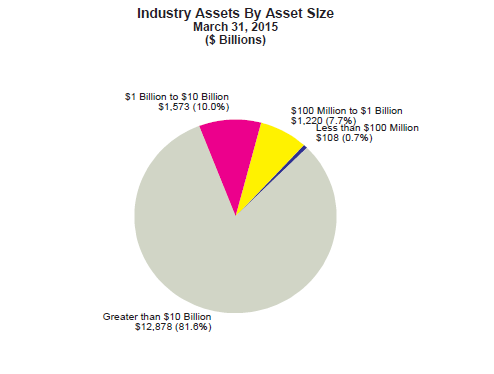

In 1990 there were 15,158 banking institutions in the United States compared to only 6,419 today – a startling decline of over 57 percent. If you think that there are fewer banking options today, you would be right. The 8,739 banks that simply disappeared since 1990 are gone forever leaving most of the industry controlled by “too big to fail” banks which now dominate the industry.

After 2012 the number of bank failures declined dramatically from the prior four years. Mergers have now become the biggest factor contributing to the declining number of banks.

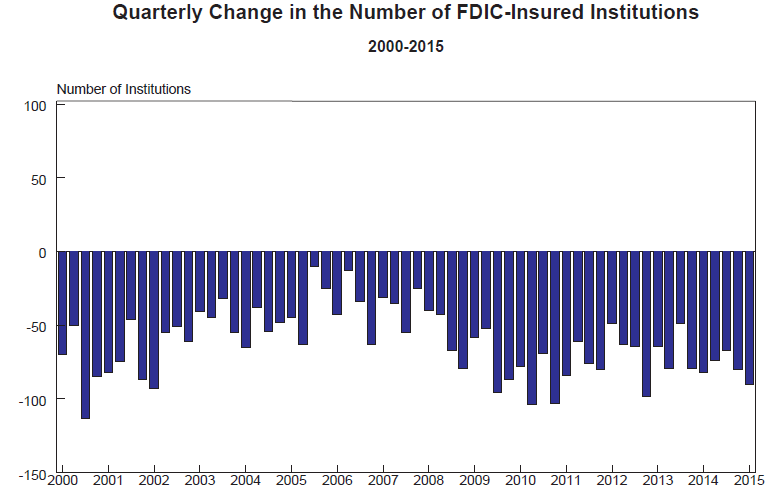

Since 2000 there has not been even one quarter in which the number of FDIC insured banking institutions increased.

There are currently only 112 banking institutions that have over $10 billion in assets yet this handful of banking giants controls almost 82 percent of the assets of the entire United States banking industry.

Speak Your Mind

You must be logged in to post a comment.