With interest rates at all time lows why wouldn’t banks love handing out home equity lines of credit (HELOC)? Since HELOCs are all written as adjustable rate second mortgages any increase in interest rates translates into instantly higher profits for banks. With a HELOC the borrower takes on interest rate risk as opposed to a […]

Eastside Commercial Bank, Conyers, GA, Becomes 13th Bank Failure of 2014

Georgia state regulators closed the Eastside Commercial Bank, Conyers, Georgia, and appointed the FDIC as receiver. In order to protect depositors, the FDIC sold Eastside Commercial Bank to Community & Southern Bank, Atlanta, Georgia, which will assume all deposits of the failed bank. Eastside Commercial Bank did not even last a decade, having been founded […]

Increased Bank Profits Mainly Due to Lower Loan Loss Provisions – When Will Real Profits Increase?

On the surface the latest FDIC Quarterly Banking Profile reflects a recovering banking industry with robust profit growth. For the fourth quarter of 2013 banks collectively reported net income of $40.3 billion which is a $5.8 billion or 16.9% increase from the previous year’s fourth quarter. Making the picture look even brighter is the fact […]

FDIC Says Problem Banks Still Six Times Higher Than in 2007

The FDIC Quarterly Banking Profile for the fourth quarter of 2013 shows a continued reduction in the number of problem banks. The total number of banks on the FDIC Problem Bank List decreased for the 11th consecutive quarter to 467 banks as of December 31, 2013 compared to 515 problem banks in the previous quarter. […]

Syringa Bank, Idaho, Becomes Third Banking Failure of 2014

Idaho state banking regulators closed Syringa Bank, Boise, Idaho, and appointed the FDIC as receiver for the failed bank. The FDIC sold Syringa Bank to Sunwest Bank, Irvine, CA, which will assume all deposits of the failed bank. Syringa Bank, founded in 1997, had total assets of $153.4 million and total deposits of $145.1 million […]

DuPage National Bank of Illinois First Bank Failure of 2014

DuPage National Bank, West Chicago, IL, was closed by the Office of the Comptroller on Friday, becoming the first bank to fail in 2014. Acting as receiver and to protect depositors, the FDIC sold the failed bank to Republic Bank of Chicago, Oak Brook, IL. Although DuPage National was a small bank with only $61.7 […]

FDIC Reports Earnings Decline For Banks In Third Quarter

The Quarterly Banking Profile released by the FDIC showed that profits for the banking industry declined for the first time since the second quarter of 2009. FDIC insured commercial banks and savings institutions reported net income of $36.0 billion for the third quarter of 2013 which was a $1.5 billion (3.9%) decline from the previous […]

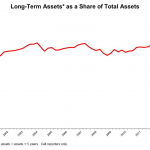

Banking Industry Losses of $51 Billion On Bond Investments Wipes Out Second Quarter Profits

Anyone with money in a long term bond fund knows first hand how quickly losses can pile up when interest rates rise. The latest Quarterly Banking Profile shows that banks , just like individuals, are subject to interest rate risk on long duration assets. Financial repression by the Federal Reserve has forced both individual investors […]

Feds Close First Community Bank of Southwest Florida – 17th Bank Failure of 2013

After a hiatus of almost two months bank failures resumed with a Florida bank becoming the 17 bank failure of the year. Regulators got back to work and closed the First Community Bank of Southwest Florida, Fort Meyers, FL, also operating as Community Bank of Cape Coral, Cape Coral, FL. The holding company for the […]