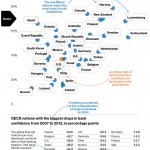

Six years after the near melt down of the United States banking industry in 2008, more than half of all Americans still lack confidence in both the banking system and the government. Interestingly the United States with some of the biggest banking institutions in the world and the implicit backing of the United States Treasury […]

FDIC Reports Earnings Decline For Banks In Third Quarter

The Quarterly Banking Profile released by the FDIC showed that profits for the banking industry declined for the first time since the second quarter of 2009. FDIC insured commercial banks and savings institutions reported net income of $36.0 billion for the third quarter of 2013 which was a $1.5 billion (3.9%) decline from the previous […]

Two U.S. Banks Included In “The World’s 20 Strongest Banks”

A short number of years ago the “too big to fail banks” had to be bailed out with trillions of dollars in financial aid from both the taxpayers and the Federal Reserve. At one point there were serious discussions about nationalizing the entire U.S. banking industry. As a sign of how rapidly America’s largest banks […]

The Rally In Big Bank Stocks May Be Over

For over the past year, the stocks of big banks have rallied significantly. Lower loan losses, a stabilization of the real estate market and a settlement with the government over shortcomings in foreclosure proceedings have all contributed to a growing conviction by investors that the worst is over for the banking industry. Here’s a look […]

Banks Are A Financial Disaster For Both Shareholders And Depositors

In days gone by, shareholders of large banks viewed their investments as a source of income via dividends and potential capital gains via share appreciation. In days gone by, depositors viewed banks as the safest place to harbor their hard earned dollars while earning a respectable amount of interest income. That was then, this is […]

What Big Bank Stock Has The Largest Price Gain In 2012?

After getting pounded during 2011, bank stocks have soared this year, especially after the Federal Reserve completed its “stress tests” and said that almost every big bank could survive “extremely adverse” economic conditions. During 2011 bank stock shareholders experienced the biggest price declines since the financial panic of 2008. As worries mounted over both the […]

Big Bank CEOs Take Home Massive Paychecks As Savers and Shareholders Get Crushed

Right or wrong, most consumers have an overwhelmingly negative opinion about big banks. According to a survey by Research and Markets, 86% of social media comments about U.S. and European banks are negative. The negative perception of big banks by the public has become so pervasive that most bank executives probably just ignore it at […]

Increase In Third Quarter Banking Profits Largely Due To Phony Accounting Gimmicks

The FDIC’s Quarterly Banking Profile for the third quarter of 2011 shows banking industry profits increasing by 48% from the third quarter of 2010. Aggregate net income of the banking industry for the third quarter of 2011 totaled $35.3 billion compared to $23.8 billion in the third quarter of 2010. Although traditional news organization headlines proclaimed “Strong Profit Growth […]

Downward Spiral Of Bank Stocks Is Predicting An Economic Crisis

After rallying last fall, many of the big bank stocks have seen substantial declines from the beginning of the year. Growing fears about the health of the banking industry are discussed in the latest Economics and Mortgage Market Analysis issued by Fannie Mae. Fannie Mae cites a very weak housing market and an economic slowdown […]