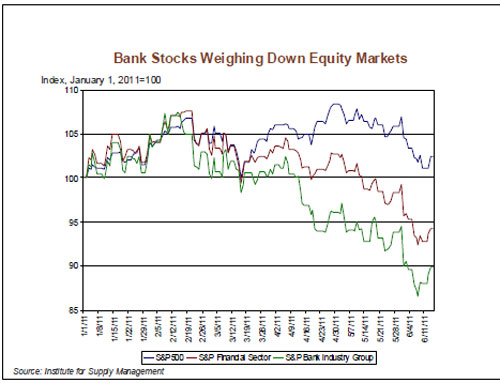

After rallying last fall, many of the big bank stocks have seen substantial declines from the beginning of the year.

Growing fears about the health of the banking industry are discussed in the latest Economics and Mortgage Market Analysis issued by Fannie Mae. Fannie Mae cites a very weak housing market and an economic slowdown as the primary factors for worries by regulators and investors about the health of bank capital levels and portfolio values. The stock prices of many major banks have declined even as equity values in general have risen.

Fannie Mae noted that regulators, in response to worries about the financial health of the banking industry, have questioned whether current regulatory capital ratios should be raised. In addition, regulators are concerned about the level of European sovereign debt held in the banking sector. The potential default by Greece and other heavily indebted members of the European Union would lead to large losses for many major European and U.S. banks.

In addition to Fannie Mae’s concerns about the integrity of bank portfolio values, insufficient capital and the risk of large losses from a contagion of sovereign defaults, the banking industry faces a host of other problems.

Economic data indicates widespread weakness in the economy. The jobless rate remains near 10%, new job creation, retail and auto sales have slowed, consumer confidence is declining, income growth is negative after inflation, housing values continue to decline, manufacturing growth has slowed sharply, new home sales remain near all time lows, unemployment claims have risen, business investment has slowed, state and local governments continue to struggle with budget deficits and 40% of the American public think we are heading into a depression.

The economic indicators say that the risk of a double-dip recession have increased. Banks, holding billions in assets of dubious value, are ill prepared for another recession. A second recession would lead to a wave of loan defaults, triggering another banking crisis.

Compounding widespread economic weakness is the looming threat of a second financial crisis due to the explosion of government debt. The Congressional Budget Office (CBO) published an issue brief last year entitled “Federal Debt and the Risk of a Fiscal Crisis” which issued a stark warning. The CBO said that the ballooning level of federal debt will “increase the probability of a sudden fiscal crisis, during which investors would lose confidence in the government’s ability to manage its budget.” The loss of investor confidence would result in the government being unable to “borrow at affordable rates.”

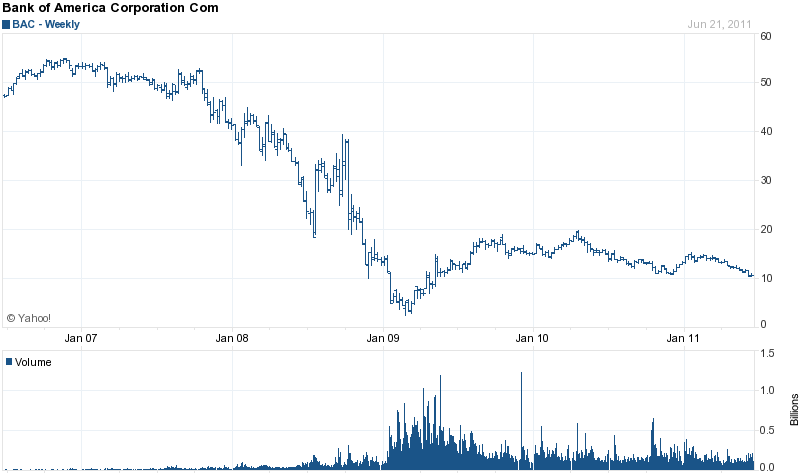

The performance of the bank stocks is forecasting a gloomy economic future. Shares of the nation’s four biggest banks (Bank of America, Citigroup, Wells Fargo, JP Morgan Chase) are all below prices reached prior to the financial crisis. The two worst performing banks stocks are Bank of America, down 80% since 2007 and Citigroup, down more than 90% since 2007.

Investors betting on a banking recovery are likely to remain disappointed.

This seems awfully prescient 6 weeks later. Bank recovery seems less likely now than when this was written. Downgrade of Fannie & Fredde have to hurt too.

This seems awfully prescient now and more so than when it was published 6 weeks ago. The news about Fannie & Freddie will only compound these issues.

This appears to be more prescient than when first written given the events fo the last several days. Freddie’s and Fannie’s problems won’t help either.