Right or wrong, most consumers have an overwhelmingly negative opinion about big banks. According to a survey by Research and Markets, 86% of social media comments about U.S. and European banks are negative.

Right or wrong, most consumers have an overwhelmingly negative opinion about big banks. According to a survey by Research and Markets, 86% of social media comments about U.S. and European banks are negative.

The negative perception of big banks by the public has become so pervasive that most bank executives probably just ignore it at this point. Big bank CEOs pained by their low ranking in public opinion polls can at least take comfort in the fact that they retain their status as some of the best compensated employees in the world.

Consider the case of Citigroup’s CEO whose Pay Climbs Toward $53 Million As Citigroup Revenue Slumps.

Citigroup Inc. (C), the second-worst performer in the KBW Bank Index (BKX) last year, is grappling with a revenue slump. Chief Executive Officer Vikram Pandit is not.

Pandit’s $15 million pay package for 2011 and a multi-year retention package announced in May could total $53 million, based on regulatory filings and an analyst’s estimate. The CEO also received $80 million last year from the New York-based firm’s purchase of his Old Lane Partners LP hedge fund in 2007.

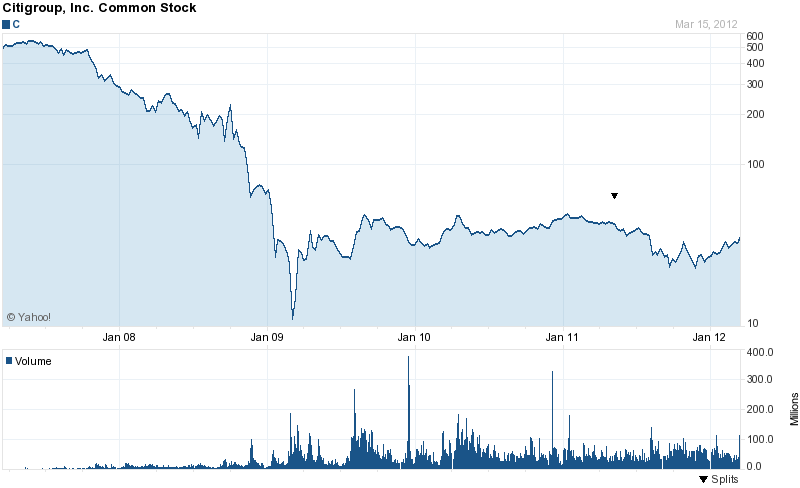

Pandit, 55, is being rewarded with more compensation after accepting a $1 annual salary for most of 2009 and 2010 as he helped the bank recover from the brink of collapse and boosted net income 4 percent to $11.1 billion last year. Still, the stock slid 44 percent last year and revenue fell almost 10 percent as Europe’s sovereign-debt crisis roiled markets.

“The awards have been very generous,” Frank Glassner, CEO of Veritas Executive Compensation Consultants in San Francisco, said in a phone interview last week. “It’s obvious Mr. Pandit has been working very, very hard, but they don’t seem to be in line with total shareholder return.”

Pandit plans to cut 5,000 jobs to pare as much as $3 billion of expenses this year, Citigroup has said.

The Bloomberg article also notes that Bank of America CEO Brian Moynihan, received $950,000 in 2011 as well as $5.9 million of restricted stock. Meanwhile, shareholders in Bank of America have seen their dividend income reduced to nothing and the value of their shares are still down over 80% from 2007.

CEO Jamie Dimon of JP Morgan Chase was paid $23 million in 2011 despite a drop in revenue of over 5% and a sagging stock price despite the fact that the Bank racked up $19 billion in profits last year.

There is nothing wrong with being highly compensated for a job well done but in the case of the banking industry there appears to be a major disconnect between bank CEO pay scales and the financial pain inflicted on shareholders, consumers and savers.

Shareholders have huge losses on their bank stock investments and the zero interest rate policy of the Fed (which benefits banks with ultra low funding costs) has resulted in the elimination of interest income for savers. While the banking industry has recovered dramatically, its customers, employees and shareholders have not.

Citigroup’s compensation of its executives is certainly not unique among the Big Banks, but it stands out as a glaring example of the misalignment between the interests of bank management, employees, shareholders and depositors.

Current CD rates at Citigroup? According to the Bank’s website, Citigroup’s “competitive” 1 year CD rate is 0.25%. A $10,000 CD will put $25 dollars in your pocket after a year and that’s before taxes. Even worse, with inflation running at almost 3%, a depositor winds up losing purchasing power of $275.

Status of Citigroup shareholders? After accounting for a 1/10 reverse stock split in 2011, an investor has seen the value of Citigroup plunge from over $500 per share in 2007 to the current price of $36.27.

Speak Your Mind

You must be logged in to post a comment.