It is always wise to pay attention to one of the greatest investment minds of all time. In the most recent letter to shareholders of Berkshire Hathaway, legendary investor Warren Buffet makes the case for a recovery of both the housing market and shares of Bank of America.

It is always wise to pay attention to one of the greatest investment minds of all time. In the most recent letter to shareholders of Berkshire Hathaway, legendary investor Warren Buffet makes the case for a recovery of both the housing market and shares of Bank of America.

Warren Buffet has shown time and again that he is a master of market values and has a propensity to buy when other investors are panicking. During the financial meltdown of 2008, while many investors were liquidating positions to flock to the safety of U.S. government treasury securities, Buffet bought large positions in Swiss Re, Goldman Sachs and General Electric, all of which later produced huge profits. Since 1965, the book value of Berkshire Hathaway stock has had an annual compounded gain of 19.8% compared to 9.2% for the S&P500.

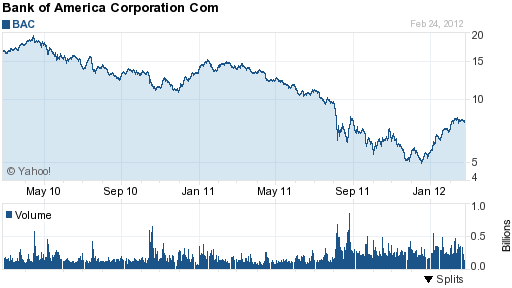

During the early part of 2011, some of world’s most successful investors had amassed huge positions in Bank of America (BAC) based on predictions of a housing rebound and the low valuation of BAC’s stock price compared to tangible book value. Investor John Paulson, who shrewdly made billions correctly betting on a housing collapse, acquired a large position in Bank of America’s stock.

Paulson’s bet on Bank of America turned out to be a disaster as continued erosion in home values along with the European sovereign debt crisis sent bank stocks worldwide into a tailspin. Bank of America’s stock plunged from $15 in January to a low of $4.92 in December.

As most investors were worrying about a collapse of Bank of America into the arms of the FDIC, Buffet stepped in and bought $5 billion of 6% preferred stock that included warrants to buy 700 million shares of Bank of America at $7.14 per share anytime before September 2 2021. Buffet’s investment is already in the black with Bank of America’s stock closing at $7.88 on Friday.

Here’s what Buffet had to say about his investment in Bank of America in his annual letter to shareholders.

At Bank of America, some huge mistakes were made by prior management. Brian Moynihan has made excellent progress in cleaning these up, though the completion of that process will take a number of years. Concurrently, he is nurturing a huge and attractive underlying business that will endure long after today’s problems are forgotten. Our warrants to buy 700 million Bank of America shares will likely be of great value before they expire.

Buffet is also optimistic on housing although his previous call for a recovery was wrong. Buffet also agrees with assessments made in this blog that many of the people who “lost” their homes actually made profits due to cash out refinances. (see Mortgage Default Is A Financial Bonanza For Many Homeowners and Foreclosure Settlement – A Victory For The Irresponsible). Here’s Buffet’s take on housing:

Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong.

As is well-known, the U.S. went off the rails in its home-ownership and mortgage-lending policies, and for these mistakes our economy is now paying a huge price. All of us participated in the destructive behavior – government, lenders, borrowers, the media, rating agencies, you name it. At the core of the folly was the almost universal belief that the value of houses was certain to increase over time and that any dips would be inconsequential. The acceptance of this premise justified almost any price and practice in housing transactions. Homeowners everywhere felt richer and rushed to “monetize” the increased value of their homes by refinancings. These massive cash infusions fueled a consumption binge throughout our economy. It all seemed great fun while it lasted. (A largely unnoted fact: Large numbers of people who have “lost” their house through foreclosure have actually realized a profit because they carried out refinancings earlier that gave them cash in excess of their cost. In these cases, the evicted homeowner was the winner, and the victim was the lender.)

In 2007, the bubble burst, just as all bubbles must. We are now in the fourth year of a cure that, though long and painful, is sure to succeed. Today, household formations are consistently exceeding housing starts.

Housing will come back – you can be sure of that…Every day we are creating more households than housing units. People may postpone hitching up during uncertain times, but eventually hormones take over. And while ‘doubling-up’ may be the initial reaction of some during a recession, living with in-laws can quickly lose its allure.

Wise monetary and fiscal policies play an important role in tempering recessions, but these tools don’t create households nor eliminate excess housing units. Fortunately, demographics and our market system will restore the needed balance – probably before long. When that day comes, we will again build one million or more residential units annually. I believe pundits will be surprised at how far unemployment drops once that happens. They will then reawake to what has been true since 1776: America’s best days lie ahead.

Buffet’s conviction that the “market system” will restore housing values correlates with the conviction of many critics that government actions to postpone foreclosures has simply prolonged the housing crisis by keeping homeowners in homes that they cannot afford.

Housing values are at ten year lows, interest rates are at all time lows and the median cost of rent exceeds the cost to own, all ingredients for an eventual housing recovery. If short sighted politicians pandering for votes would step aside and let the dynamics of a free market system work, Buffet’s prediction of a housing recovery will come much sooner than many believe.

BAC will be back up to 20 a share in two years and I will pocket a nice profit seeing how I bought in at 5.13 a share.

Nice!