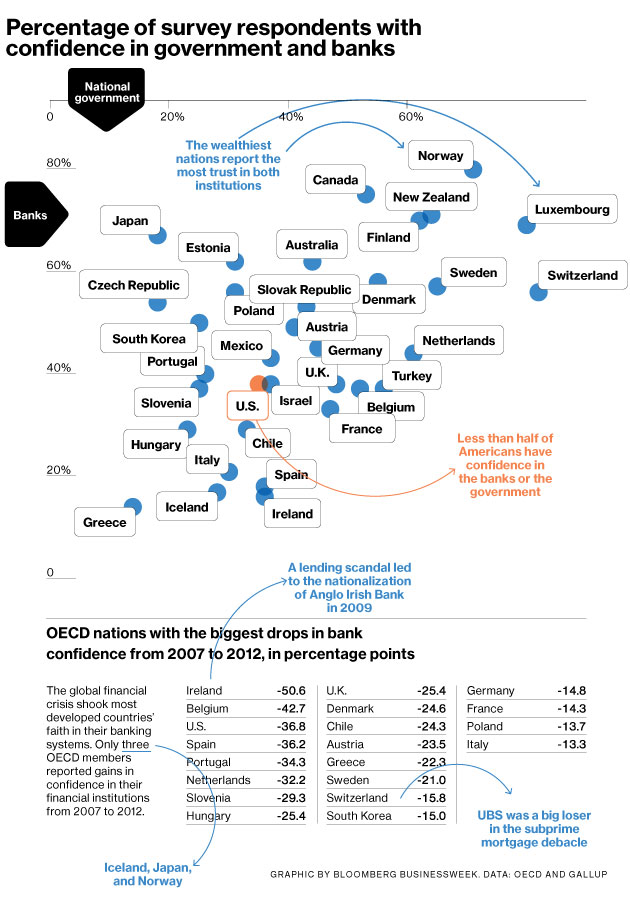

Six years after the near melt down of the United States banking industry in 2008, more than half of all Americans still lack confidence in both the banking system and the government.

Six years after the near melt down of the United States banking industry in 2008, more than half of all Americans still lack confidence in both the banking system and the government.

Interestingly the United States with some of the biggest banking institutions in the world and the implicit backing of the United States Treasury scored the third worst rating of consumer confidence in banks after Ireland and Belgium.

Ironically, France and Italy, with huge public deficits, weak banking institutions, high taxes, and massively expensive welfare state obligations scored the lowest in consumer loss of confidence.

Public confidence in banks is an absolute necessity under a fiat currency system. The intrinsic value of any fiat currency ultimately depends upon the ability of governments to maintain public confidence that the value of paper money will retain purchasing power over time. The moment confidence in paper currency is lost by the public, a giant game of musical chairs will commence during which currency holders will began a mass exodus out of dollars and into tangible goods that have a better chance of retaining value and purchasing power.

In a keynote address by Mr. Stefan Ingves, Chairman of the Basel Committee on Banking Supervision for the Bank of International Settlements (BIS), noted that banking is a business built on confidence. The financial crisis, in Mr. Ingves’s view was “in essence a complete collapse in confidence” brought about by the inability of banks to properly measure risk and an inadequate regulatory framework which contributed to a severe lack of bank capital cushions when they were needed most.

Have recent regulatory overhauls and reforms done enough to prevent a future banking crisis? Based on recent event such as a surprise $2 billion dollar loss on trading positions that JPMorgan Chase had deemed to be low risk and well hedged, one would be hard pressed to say that future huge banking losses have a low probability of occurrence.

The BIS is working on proposals to increase banking capital to cushion future adverse financial scenarios but as Mr. Ingves notes, “modern banks are highly leveraged institutions and fractional reserve lending can only be successful when lenders to a bank have full confidence that it has the financial strength to meet its obligations as and when they fall due.”

Despite the incredibly complex rules that are still being promulgated under the Dodd-Frank Act, banks remain at substantial risk of failure in another severely adverse financial crisis simply because no know really understands the incredible complexity and risks of a modern bank and exactly what scenario would unfold when the next financial shock rocks the banking system.

The public may not understand all the complexities and risk associated with the “too big to fail banks” but there seems to be a generous amount of doubt about the big banks ability to survive another financial meltdown.

The Austin bank Of Texas is the bank that has some of the largest losses mounting in state history. The bank as done an exceptional job of hiding these losses on their books by filing large unprecedented judgments on there [ast customers. Some of these liens of been over 1 million dollars on an $83,000 note. If they can hold off for years then they will come at you before statutes run out and file judgments only 2% of these are challenged which leaves the bank showing on their books they made 83 million in profits which in actuality they would have lost 9 million. So it is a ponzi scheme orchestrated by attorneys and bankers throughout texas and mostly in a few prominent banks in texas.