With interest rates at all time lows why wouldn’t banks love handing out home equity lines of credit (HELOC)? Since HELOCs are all written as adjustable rate second mortgages any increase in interest rates translates into instantly higher profits for banks. With a HELOC the borrower takes on interest rate risk as opposed to a 30 year fixed rate mortgage in which the lender takes all the risk of being stuck with a low yielding loan if mortgage rates rise.

With interest rates at all time lows why wouldn’t banks love handing out home equity lines of credit (HELOC)? Since HELOCs are all written as adjustable rate second mortgages any increase in interest rates translates into instantly higher profits for banks. With a HELOC the borrower takes on interest rate risk as opposed to a 30 year fixed rate mortgage in which the lender takes all the risk of being stuck with a low yielding loan if mortgage rates rise.

With a recovery in housing prices, low interest rates, and banks searching for ways to lend money Home Equity Loans Surge as Rates Fall to Lowest Since 2008.

Lenders increased their origination of home equity lines of credit, or Helocs, by 21 percent in the 12 months ending in June, data firm RealtyTrac Inc. said today. The 797,865 Helocs given in the period represent the highest level since 2009.

Bank of America Corp. and other lenders are providing more Helocs, often to their existing customers at reduced rates, as rising prices gives them more equity in their homes. At the same time, banks have been cutting lending for home purchases after imposing stiff requirements on borrowers to comply with new regulations and stem losses from the 2008 housing crash. Many younger Americans, who often have lower credit scores, have been shut out of the market.

“This is an opportunity for the banks to offer an additional product to those homeowners they see as already well qualified and have that equity,” said Daren Blomquist, vice president of Irvine, California-based RealtyTrac. “Helocs are a way for them to actually expand their mortgage businesses rather than have to cut back.”

For consumers a HELOC is one of the best ways to borrow money – it’s like having a credit card for instant use except the HELOC offers very low rates and the interest is tax deductible. Borrowers approved for a home equity line of credit receive a specific amount that they can borrow anytime they chose to. For example, a borrower approved for a $50,000 HELOC can access part or all of that amount anytime he chooses to simply by writing a check.

Interest is paid only on the amount actually borrowed and the loan can be paid back at any time. The monthly payment on a HELOC is based only on the interest due which keeps the payment as low as possible. Once approved for a HELOC a borrower is under no obligation to borrow but has the line accessible as the need arises.

HELOCs are a bargain for consumers compared to a first mortgage which involves multiple layers of costly fees. Most banks offer no closing cost HELOCs and there are usually no annual fees. The only extra fee a consumer may face is if the line is closed within two or three years since the bank needs to recoup the original cost of originating the loan.

On a HELOC I have from Bank of America, the interest rate currently is about 3% which means that the monthly payment on a $20,000 loan is only about $50 per month.

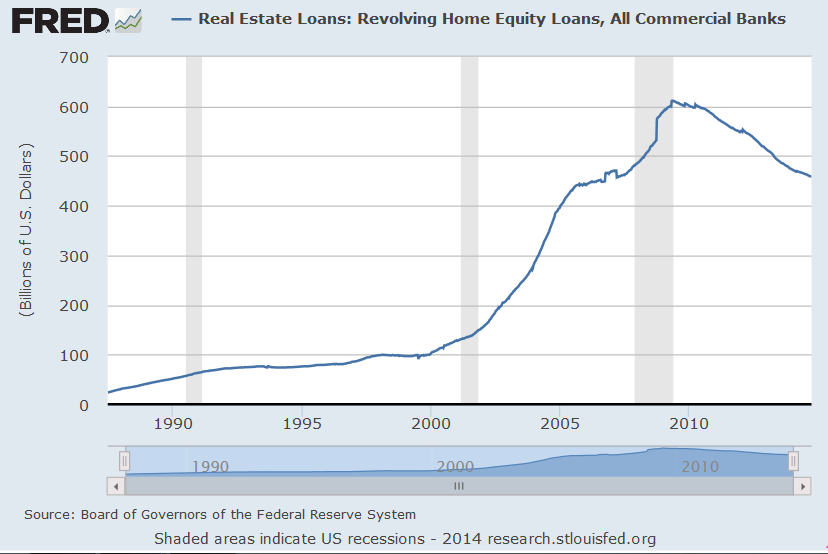

Despite Bloomberg’s assertion that banks are increasing HELOC lending, the figures have not yet shown up in the numbers published by the Federal Reserve. After going on a lending rampage during the housing boom, the amount of HELOC loans is still in a downtrend according to the St. Louis Federal Reserve.

Many of the “new HELOCs” being originated by banks are probably new loans to replace those that are expiring. A HELOC is typically written with a ten year term at which time the loan balance must be paid off, refinanced or converted to a 10 or 15 year loan. Borrowers with HELOCs coming due can be in for some big time payment shock if they can’t get a new HELOC. If a borrower is forced to convert to a fixed or adjustable rate loan the rate will be much higher and the amortization period much shorter resulting in a payment far above what was being paid on the original HELOC.

In the Bank of America HELOC cited above, my loan term was due to expire and the Bank gave me three choices.

- Apply for a new HELOC and transfer the existing balance on which I would continue to pay interest only

- Pay off the balance in full

- Repay the HELOC principal by converting to a 15 year adjustable rate loan on which the starting payment would be $162.28 per month which was a monthly payment increase of $112 or 228% higher than the existing payment.

The problem many people have with HELOCs whose term is expiring is that they can’t pay off the loan and don’t qualify credit wise for a new HELOC. Some industry analysts are predicting a wave of defaults by people who can’t qualify for a new HELOC and get stuck with a much higher payment when the loan converts.

What can banks do to help people who can’t refinance to another interest only HELOC? Not much unfortunately due to new stringent lending laws imposed by the Dodd-Frank Act. Many of the borrowers that new lending regulations were supposed to protect may wind up wishing that banks were allowed more leeway to make common sense lending decisions instead of being constrained by rigid new lending laws.

Speak Your Mind

You must be logged in to post a comment.