Anyone with money in a long term bond fund knows first hand how quickly losses can pile up when interest rates rise. The latest Quarterly Banking Profile shows that banks , just like individuals, are subject to interest rate risk on long duration assets.

Financial repression by the Federal Reserve has forced both individual investors and banks into long duration bonds which have collapsed in value during the second quarter as long term interest rates nearly doubled.

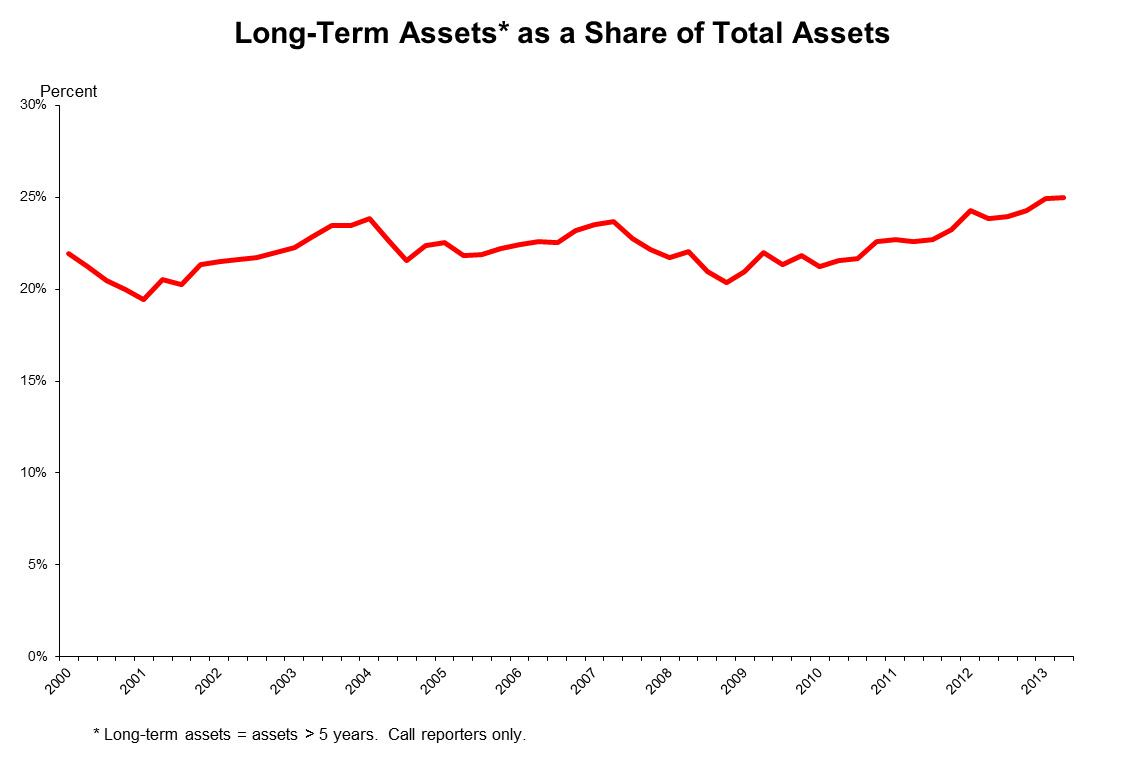

Banks have been reaching for yield by piling into long dated mortgage-backed securities and treasuries. Long-term assets as a share of total bank assets have been increasing since 2009 as banks sought to increase interest income to offset weak loan demand and fee reductions forced on the banks by new regulations.

Interest rate risk has been an ongoing concern of bank regulators and for good reason. Even though the banks are investing in safe assets from a credit standpoint, holding long term assets exposes banks to large losses in market value when interest rates rise.

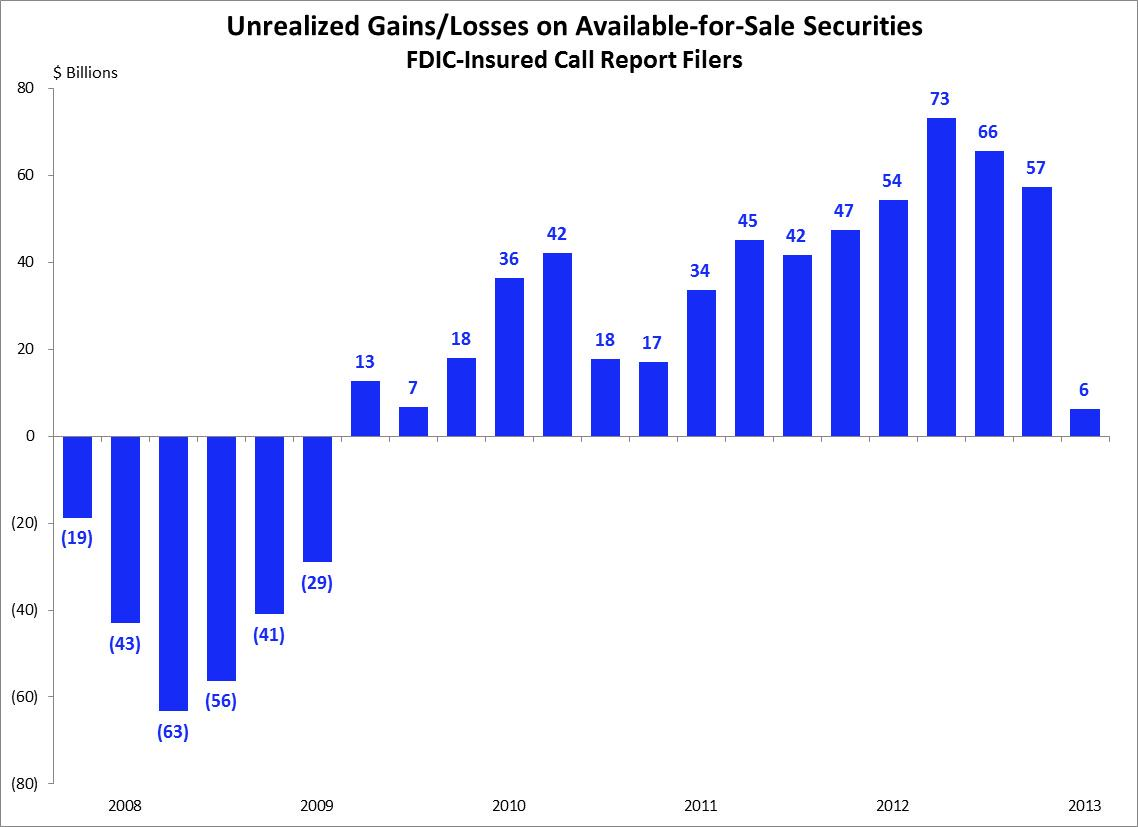

The mainstream press reports on bank earnings for the second quarter focused on the record breaking earnings of $42.2 billion while ignoring a huge decline of $51 billion in unrealized gains on long term assets. As interest rates soared in the second quarter the value of long term bonds held by banks plunged in value by the largest amount since banks started reporting this data in 1994.

Under an accounting quirk the $51 billion loss does not affect bank earnings but can reduce the book value of a bank. Unrealized losses on long term bonds classified as “available-for-sale” can be deferred and do not affect current earnings unless the securities are sold. If the Federal Reserve starts to reduce the amount of bonds it has been purchasing under QE2, interest rates could continue to rise which would result in additional losses on long term bonds held by banks.

Under current banking regulations unrealized gains and losses on available-for-sale securities do not affect regulatory capital but they will under the new Basel III capital rules for large banks.

Banks had record breaking earnings this quarter but if interest rates continue to increase, the huge losses on long term bonds in bank portfolios will at some point start to negatively impact earnings.

Speak Your Mind

You must be logged in to post a comment.