The earnings “recovery” in the banking industry continues to be driven by reduced loan loss provisions and higher fees rather than a fundamental improvement in the core lending business.

The FDIC’s Quarterly Banking Profile for the first quarter of 2012 reports that aggregate quarterly profits of commercial banks and savings institutions increased for the 11th consecutive quarter on a year-over-year basis. For the quarter ending March 31, 2012, banking industry profits totaled $35.3 billion, up $6.6 billion from $28.8 billion reported for the first quarter of 2011.

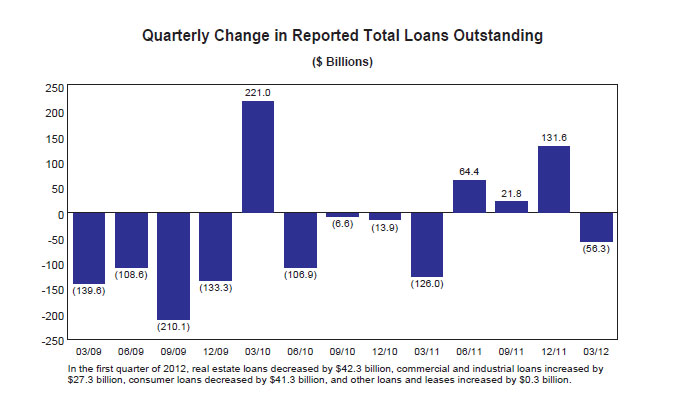

As in the previous quarter, virtually all of the profit growth in the banking industry came from reductions in provisions for loan losses and higher noninterest income rather than from increased lending activity. For the first quarter of 2012, total loan balances decreased by $56.3 billion or 0.8%. FDIC Acting Chairman Martin Gruenberg noted that “The overall decline in loan balances is disappointing after we saw three quarters of growth last year…The improved financial condition of the industry has not yet translated into loan growth. We will continue to watch this indicator closely.”

The outright decline in lending by the banking industry raises serious concerns about the health of the U.S. economy. Both consumers and businesses are spending less and borrowing less. The vast majority of consumers have seen minimal income growth since 2008 and unemployment remains at historically high levels – two factors that encourage consumers to deleverage and spend less. Faced with reduced demand from consumer spending (which constitutes two thirds of the U.S. economy), businesses see little reason to borrow to expand production or hire new employees.

Despite ultra low interest rates and the expenditure of trillions of dollars in economic “stimulus spending” since 2008, the U.S. economy has had the weakest economic recovery after a recession since the 1940’s. Negative loan growth during the first quarter suggests a slowdown in the U.S. economy. The ongoing banking crisis and recession in Europe also represent major risks to both the U.S. economy and banking system.

Loan loss provisions for the first quarter of 2012 were $14.3 billion, representing a decline of $6.6 billion from the $20.9 billion set aside for loan losses reserves in the first quarter of 2011. Net interest income and total noninterest income increased by $5 billion from the previous year, bolstered by gains on loan sales and realized gains on investment securities. The reduction in loan loss provisions and gains in noninterest income accounted for almost all of the banking industry’s profit gains in the first quarter.

The number of banks reporting losses for the first quarter of 2012 declined to 10.3% from 15.7% in the previous year while 67.5% of all institutions reported improved quarterly net income. The average return on assets rose to 1.02% from 0.86% in the previous year.

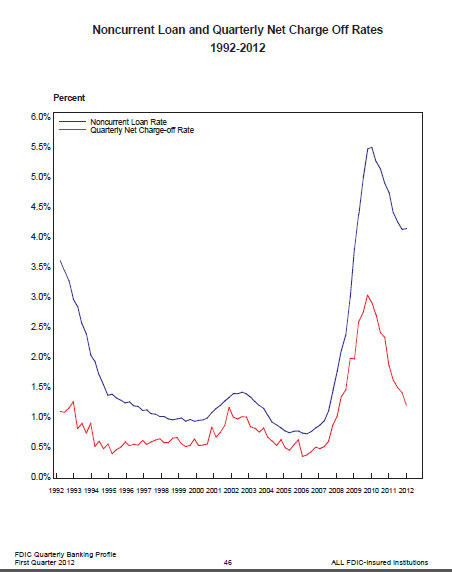

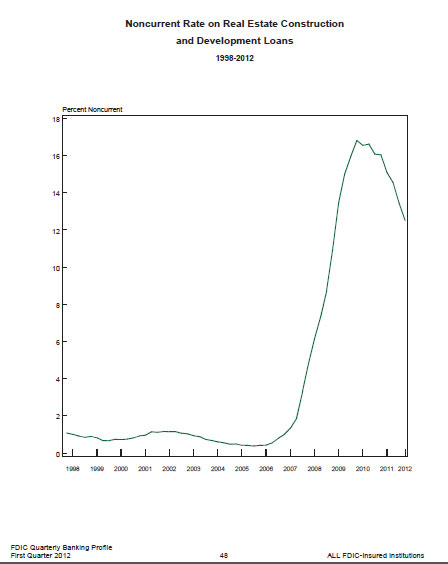

During the 2012 first quarter, banks charged off $21.8 billion of uncollectible loans compared to chargeoffs of $33.5 billion in the previous year. Although the amount of loans and leases seriously past due declined for the eighth consecutive quarter, delinquency rates remain very high by historical standards, especially for real estate construction and development loans.

Insured deposit growth slowed during the quarter to $67.8 billion after increases of over $200 billion during the three previous quarters. Money flow into noninterest bearing transaction accounts dropped by $77.3 billion after increasing by over $532 billion during the previous three quarters. Noninterest bearing transaction accounts currently have unlimited deposit insurance coverage which attracted a huge flow of money fleeing from the troubled European banking system (see $1.2 Trillion of Nervous Money Floods Into U.S. Banking System).

The number of banks on the confidential FDIC Problem Bank List as of March 31, 2012, declined to 772 from 813. The total assets of problem banks declined to $292 billion from $319 billion.

The Deposit Insurance Fund (DIF) balance increased to $15.3 billion at March 31, 2012, up from $11.8 billion at December 31, 2011. The DIF balance increased during the quarter due to increased deposit assessment collections and a reduction in the number of failed banks. The contingent loss reserve that covers the expected cost of banking failures declined from $6.5 billion to $5.3 billion during the quarter. The $15.3 billion in the FDIC Deposit Insurance Fund protects approximately $7 trillion of insured deposits.

I now understand why small business lending by regualted financial institution remain weak. I was just grilled by my bank for seeking approval for a cash secured line of credit. I thought it would tbe he easiest loan to get approved, virtually, risk free. I believe fear is running rampant in banks.