Home Savings of America, which was established during the depths of the Great Depression, was closed by regulators today. The Bank was established on September 1, 1934 and operated as a federally chartered stock savings and loan association, headquartered in Little Falls, Minnesota.

According to Home Savings of America’s website, the Bank’s niche was serving senior citizens with products appropriate for a retired stage of life. The Bank offered many products rarely seen by banks today such as free checking accounts and no fee travelers checks. Home Savings of America also specialized in mortgage lending which proved to be its undoing as real estate values crashed along with the economy in 2008.

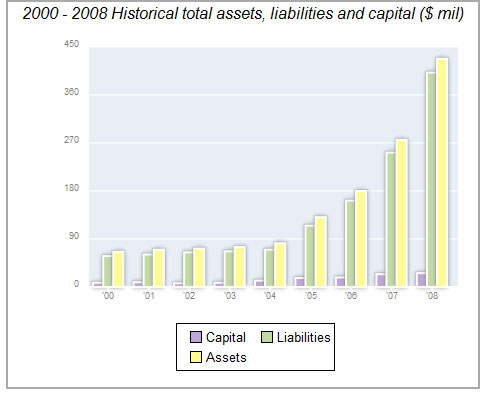

Home Savings of America was a relatively small bank with under $100 million in assets until 2004. Swept up by the real estate boom and easy lending practices, Home Savings ramped up its lending at an incredible pace starting in 2005 and by 2008 (the peak of the real estate bubble), the Bank’s assets had exploded to almost $450 million.

It was relatively easy to conduct huge amounts of mortgage transactions during the real estate boom since borrowers with relatively low credit scores could borrow with nothing down and without verifying income. The Office of the Comptroller of the Currency (OCC) which closed down Home Savings noted that the Bank “had experienced substantial dissipation of assets and earnings due to unsafe or unsound practices.” The OCC had issued a Cease and Desist Order to Home Savings in July 2010 citing “unsafe and unsound practices” but the Bank was unable to cure the operational and financial deficiencies cited by the OCC.

After shutting down Home Savings of America, the OCC appointed the FDIC as receiver. The FDIC was unable to find a buyer willing to purchase Home Savings. Typically, the FDIC is able to attract a purchaser for a failed bank with generous guarantees to cover losses on failed banks through the use of loss-share agreements.

Potential purchasers may not be interested in purchasing a failed bank for a variety of reasons. A bank buying a failed bank does so with the expectation of expanding their banking operations in a profitable manner. If the asset quality of a failed bank is very poor, the FDIC may not be able to find a buyer under any circumstances and this is what occurred with the failure of Home Savings of America.

Although it is unusual for the FDIC to be unable to attract successful bids for a failed bank, the case of Home Savings is not unique. During 2011, the FDIC was unable to find a purchaser for two failed banks. Between January 2009 to December 2010, the FDIC could not find buyers for 19 banks and was forced to liquidate the banks and payoff depositors.

At December 31, 2011, Home Savings of America had total assets of $434.1 million and total deposits of $432.2. The FDIC will be forced to retain all of the assets of Home Savings. The FDIC already holds $30 billion of junk assets (technically known as “resolution receivables balance”) that it has accumulated from other failed banks and was unable to sell (see FDIC Has A $30 Billion Junk Loan Problem).

The failure of Home Savings will be handled by the FDIC as a payout. Checks to depositors will be mailed out on Monday, February 27, 2012, up to the deposit insurance limit of $250,000.

One unique but discomforting aspect of a failed bank that cannot be sold is that depositors may very well wind up losing money. Typically when a bank fails, the purchaser of a failed bank will assume all deposits, meaning that depositors over the FDIC insurance limits do not lose any of their money. In this case, depositors who are above insurance limitations are looking at the worst aspect of a bank failure – the painful loss of depositor savings.

Here is what the FDIC had to say to regarding accounts above $250,000.

1. What if I have more than $250,000 in my accounts at Home Savings of America?

If you have more than $250,000 in your interest-bearing account, or if the total of your related interest-bearing accounts exceeds $250,000, your accounts may require review by an FDIC Claim Agent. You should call the FDIC to schedule a telephone appointment with an FDIC Claim Agent at (800)523-8089.

If you have an interest-bearing account or group of interest-bearing accounts that exceeds $250,000, you may need to complete certain declarations or affidavits and provide documentation so that the FDIC can make an insurance determination on your account(s).

The FDIC estimated the loss to the Deposit Insurance Fund at $38.8 million. This amount seems to be unusually, almost suspiciously low, compared to previous banking failures and after considering the fact that Home Savings had such poor asset quality that the FDIC could not attract a buyer.

The “estimated loss” on Home Savings amounts to only 9% of total assets. By comparison, for all of 2011, the ratio of losses on failed banks to total assets of failed banks was 20%. The ratio of losses to total assets for 2012 bank failures prior to today was 31.5%. The loss estimates on failed banks are subject to later revision and it will be interesting to see by how much the “loss estimate” on Home Savings later expands.

Home Savings of America is the 11th banking failure of 2011 and the second in Minnesota.

Wasn’t this suppose to read “Swept up by the illegal and predatory loan practices”. Was this savings and loan gambling in the stock market with the seniors retirement funds? How many of the executives of the bank have been prosecuted and what were the “bonuses” or compensation to the executives for guiding a bank into failure.

Good point.

This from the New York Times:

In Financial Crisis, No Prosecutions of Top Figures

Review some facts. Homesavings of America was NOT founded in the years of the great depression. It was Community Federal Savings & Loan an institution that was maintained by a group of men who cared for the community. Not the Group of greedy men who purchased this bank in early 2000 & helped to put this country into lopsided housing financial crisis it is in today.

According to the FDIC, the original bank was established on September 1, 1934

The latest iteration of HSoA was related in name only- the original chain of lending institutions was effectively shuttered after the failure of Washington Mutual after the acquisition of the “original” HSOA (the child of H.F. Ahmanson & Co.) in 1998.

The “new” company had relatively small deposits and was focused mostly on mortgage banking, and after a C&D order on its Texas operations, tried unsuccessfully to find a merger partner to comply with capital increase requirements.

No one is going to quit this “financial dance to the death” until someone fires the orchestra……But, we can’t expect anything of the sort from a thoroughly corrupt political system that involves both major parties.

Well At least you didnt give your two weeks notice At your old job And your first Day of Work was supposed to be 02/27/2012! I got a Call sunday night saying sorry the bank is closed, dont come In, theres no job!! They had to know there were problems why did they hire me?? It sucks!

My mortgage was with them. now what?

According to the FDIC:

The FDIC, as receiver, is retaining all assets of Home Savings and advises loan customers to “continue to make their payments as usual”.

What if a large enough bank or several banks go under using up all the FDIC funds? Wouldn’t the FDIC itself become insolvent and resort to a freeze on withdrawls until it gets more money from Congress?

Good point. During the depths of the financial crisis, many feared that the FDIC would go broke and measures were taken in 2009 to ensure that the FDIC had enough funds to prevent widespread bank collapses and depositor loses.

FDIC Requests Massive Line of Credit From Treasury

The FDIC previously projected a substantially higher bank failure rate over the next couple of years and admitted that the DIF could be completed wiped out this year which is exactly what has happened. The FDIC DIF fund of $9.2 billion at December 31, 2011 provides deposit insurance protection on $6.98 trillion of insured deposits – see DIF Fund Running on Empty.

The FDIC views the line of credit at the Treasury as being available to cover “unforeseen losses”. If that is the case, then the FDIC must have seen the potential for massive “unforeseen losses” since it requested and was approved for an increase in the line of credit from the Treasury to $500 billion from the current $30 billion. This increased line of credit would be available to address “systemic risks” and potentially allow the FDIC to inject funds into banks that otherwise would face closure. The FDIC has admitted that it cannot presently resolve more failed banks without depleting its insurance fund and potentially panicking the public.

On May 20, 2009 the President signed into law a bill authorizing increased FDIC insurance coverage on deposits as well as an increase of the FDIC’s line of credit with the Treasury.

The new law increases the FDIC’s line of credit at the Treasury to $100 billion from $30 billion.

Dirk and his wrecking crew strike again. CFIC in St. Pete’s, FL is just another prime example of why this bank was drove into the ground. Kudos Dirk and Matt….Real standup kinda guys!

Isn’t it nice to know that after you leave the company, now my 401k been seized and I have to edit until the FDIC lifts the blackout and I left in November 2011, today is May 2, 2012!

What if I stop making my mortgage payments. Who is going to come after me? Is it the government (FDIC?) and how long will it take for them to foreclose on something underwater anyway?

And now Dirk is President of another Mortgage company (Guaranty Mortgage). His bio posted on the company website and in a company release has o mention of the 5j= years it took him to ruin HSOA.

My mom just passed away and I found 2 savings account books. Am I understanding that this bank is closed and all monies lost, so there is nothing to pursue?

@Janette; that is not true by any means! You need to contact the FDIC and you can file your claim and you will get the money obviously with proper documentation. Do not hesitate. Your message was from a few months ago and I use to work for HSOA. I obviously lost my job at the time. Call the number from the article above. State your case to them and within a couple of months, you will get the money; FDIC Claim Agent at (800)523-8089. I had a 401K with HSOA, I know laughable right? I got my money though 6 months later directly from the FDIC but in this case you will get the money from your mothers account no question about it. I wish you best of luck.

Good point. In the past the FDIC has even covered deposits above the deposits insurance limits when a buyer for a failed bank could not be found.

We had our mortgage refinanced through this particular agency and would you believe that when they did the quick deed on our particular loan, they did not put our full names with spouse or husband and wife, jointly or anything like that. Just our names and now it has come to the point my husband is dead and there is no one accountable that I have to take this through probate in order to get this straightened out. They probably did not even get an attorney to do all of this paper work. I am thoroughly ticked off about this kind of business.

I recently discovered that my deceased Father my had a safe deposit box with the Home Savings of America Marysville, California Branch. What do I do?

I am the Executor for a deceased Home Savings of America multiple account holder. How do I go about seeing if they had any funds still on deposit there that the estate now needs to put in a request to return to the estate?