The second largest bank failure of the year occurred today as regulators closed down Community South Bank, Parsons, Tennessee, which had total assets of $386.9 million as of June 30, 2013. The largest bank closing of the year in terms of total assets occurred on June 7, 2013 when regulators shuttered Mountain National Bank, also […]

Banking Industry Slowly Recovers – 813 Banks Remain On “Problem Bank List”

The FDIC’s Quarterly Banking Profile for the fourth quarter of 2011 shows a modest but steady recovery in the banking industry. Despite the fact that a majority of banks reported improved quarterly earnings, 813 institutions remain on the Problem Bank List, comprising 11% of all FDIC insured banks and savings associations. Highlights of the 2011 […]

FDIC Forecasts $19 Billion In Losses On Banking Failures – Why The Losses Will Be Five Times Larger

The FDIC today released an update on expected losses for banking failures through 2015. For the five year period 2011 through 2015 the FDIC is forecasting total losses from banking failures of $19 billion. Total losses from banking failures during 2010 were $23 billion compared to $6.4 billion in 2011 year to date losses. A […]

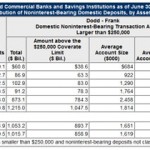

$1.2 Trillion Of Nervous Money Floods Into U.S. Banking System

With the European banking system tottering on the brink of collapse, nervous holders of cash have flooded the U.S. banking system with $1.2 trillion of deposits. Panicky holders of large amounts of cash are taking advantage of a provision of the Dodd-Frank Act that provides unlimited FDIC insurance coverage on noninterest-bearing transaction accounts. The Dodd-Frank […]

FDIC Quarterly Banking Profile Shows Increase In Problem Banks

The latest FDIC Quarterly Banking Profile (QBP) shows another increase in the number of problem banks. The mortgage and debt crisis that began in 2007, along with continued weakness in the economy has resulted in a huge increase in the number of problem banks. In 2007, the FDIC had a total of 76 institutions on […]

FDIC Warns Banks On Potential Losses By Depositors

The ultimate nightmare for a bank customer is to have uninsured funds in a failed bank. Depositor losses at FDIC insured institutions occur more frequently than most people realize. Twice already in 2011, depositors at two failed banks have lost money on uninsured deposits. When a bank fails, the FDIC as receiver, will typically find […]

$2.3 Trillion In Uninsured Bank Deposits Cause For Concern

December 22, 2010 – The latest FDIC Quarterly highlights the ongoing concern about the FDIC’s ability to protect depositors in the event of a large number of banking failures. Without the explicit backing of the FDIC by the US Treasury, the FDIC lacks the resources to adequately protect the $5.4 trillion in deposits that it […]

Six Problem Banks With $1.2 Billion In Assets Fail – Failed Banks For Year Total 157

The number of failed banks reached 157 as regulators closed six banks in Florida, Georgia, Arkansas and Minnesota. The six failed banks this week had a total of $1.2 billion in assets and resulted in a loss to the FDIC Deposit Insurance Fund of $267.6 million. The total loss to the depleted FDIC Deposit Insurance […]

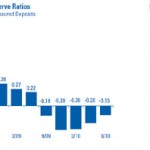

FDIC Projects Losses Of $50 Billion On Failed Banks – Insurance Fund To Remain Underfunded For Decades

December 14, 2010 – The current banking crisis has completely depleted the FDIC’s Deposit Insurance Fund which currently has a negative balance of $8 billion. In an effort to rebuild the insurance fund that protects depositors from loss when banks fail, the FDIC Board approved a rule to set the designated reserve ratio (DRR) at […]

FDIC 2010 Third Quarter Banking Profile

Today, the FDIC released its latest quarterly banking profile, which highlighted an increase in earnings for FDIC-insured institutions. For the third quarter of 2010, commercial banks and savings institutions insured by the FDIC reported aggregate profits of $14.5 billion compared to only $2 billion in the year ago period. However, the results did represent a […]