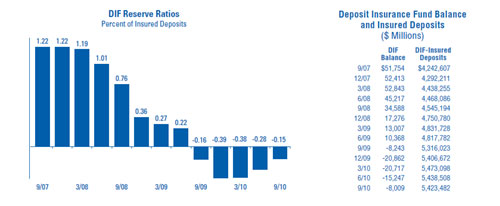

December 22, 2010 – The latest FDIC Quarterly highlights the ongoing concern about the FDIC’s ability to protect depositors in the event of a large number of banking failures. Without the explicit backing of the FDIC by the US Treasury, the FDIC lacks the resources to adequately protect the $5.4 trillion in deposits that it currently insures.

The FDIC insurance fund was never designed to handle a large scale banking crisis and this was proven during the recent banking crisis when the U.S. taxpayer was forced to rescue the banking system with a $700 billion TARP bailout plan.

The funding for the TARP program was eventually reduced to a maximum of $475 billion. The US Treasury found it necessary to disburse $245 billion to banks and financial institutions to stabilize the financial system. In addition, another $151 billion has been spent to date preventing the failure of Fannie Mae and Freddie Mac.

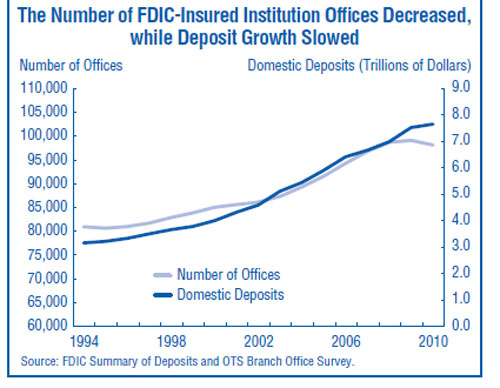

Knowing that the U.S. Treasury will backstop the FDIC Insurance Fund may provide the necessary confidence to depositors that their savings are safe from loss. Of much greater concern to the financial system in the event of another financial crisis is the large amount of deposits held by financial institutions that are not insured. FDIC insured institutions currently hold $2.33 trillion in deposits not covered by FDIC deposit insurance.

Uninsured depositors are likely to panic and withdraw deposits at the first sign of trouble. An otherwise sound institution, subject to rumors and large depositor withdrawals, may suddenly find itself on the brink of failure due to a classic run on the bank. This may be exactly what happened to Washington Mutual when panicky depositors withdrew $16.7 billion in ten days and the FDIC, fearing a nationwide financial panic, quickly closed Washington Mutual and sold it to JP Morgan Chase.

As regulators work on requiring banks to increase capital positions to prevent another banking crisis, they should also address the risk to the system of uninsured deposits. In times of financial uncertainty and facing the potential loss of large amounts of money, uninsured depositors could easily topple large financial institutions through a classic “run on the bank”.

Speak Your Mind

You must be logged in to post a comment.