It’s not easy being a banker. For example, how do you make up lost revenue from reduced loan demand?

It’s not easy being a banker. For example, how do you make up lost revenue from reduced loan demand?

In the aftermath of the financial crisis of 2008, banks have been struggling to increase revenues as loan growth remains anemic. For the quarter ending March 31, 2012, total loan and lease balances of all FDIC insured institutions declined $56 billion or 0.8%.

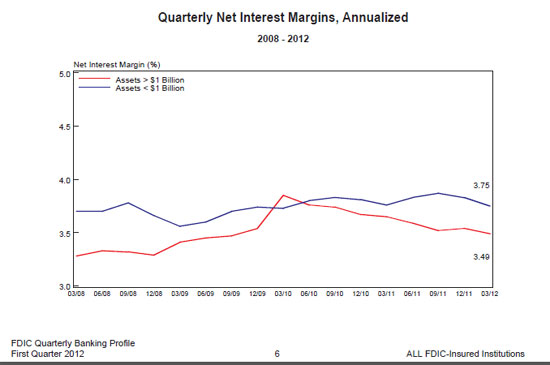

Almost all major categories of lending declined including credit cards, residential real estate, home equity lines of credit, small business , real estate construction and land loans. Compounding a difficult situation, net interest margins declined on a year over year basis from 3.66% to 3.52% as the Federal Reserve continues to force interest rates to all time lows. Smaller banks with assets under $1 billion have been hit the hardest experiencing a steady decline in net interest margins since March 2010.

It didn’t take very long for the banking industry to adapt to lower interest income due to reduced loan demand. Unable to expand asset revenue, banks quickly turned their attention to the liability side of the balance sheet. As most bank depositors may have noticed, fees for all types of banking services have increased dramatically as banks strive to increase their profitability.

The quest for additional fees has now gotten some overzealous banks into trouble with the FDIC by trying to charge depositors fees to cover the cost of FDIC deposit insurance. The banks involved have imposed fees variously described as FDIC Assessments, FDIC Insurance Premium Fees or simply FDIC Fees .

In a Financial Institution Letter covering this matter, the FDIC makes it clear that while they have no objection to banks passing on the cost of FDIC insurance fees to depositors, the fee cannot be explicit.

The FDIC discourages institutions from specifically designating that a customer fee is for deposit insurance or from stating or implying that the FDIC is charging such a fee. Institutions that characterize fees in this manner may (1) reveal information that could be used to determine an institution’s confidential supervisory ratings, (2) mislead customers into believing that the FDIC charges IDI customers or requires IDIs to charge customers for deposit insurance, or both.

Based on the FDIC guidance, banks will no doubt continue to charge “FDIC Fees” after a change in nomenclature. Fees have become an integral part of the revenue stream for the banking industry, accounting for 31% of total income. According to the FDIC, total interest income of all insured depository institutions for 2011 totaled $507 billion and total noninterest income totaled $230 billion.

Bottom line for consumers – as you receive zero interest on your bank savings, don’t expect to see a reduction in bank fees anytime soon.

Speak Your Mind

You must be logged in to post a comment.