Potential losses on Bank of America’s massive $75 trillion book of risky derivative contracts has just been dumped onto the FDIC by the Federal Reserve. Derivatives, once described by Warren Buffet as “financial weapons of mass destruction” are complex contracts entered into for speculation or to hedge risks linked to a wide variety of other […]

FDIC To Cover Losses On $75 Trillion Bank of America Derivative Bets

$1.2 Trillion Of Nervous Money Floods Into U.S. Banking System

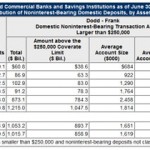

With the European banking system tottering on the brink of collapse, nervous holders of cash have flooded the U.S. banking system with $1.2 trillion of deposits. Panicky holders of large amounts of cash are taking advantage of a provision of the Dodd-Frank Act that provides unlimited FDIC insurance coverage on noninterest-bearing transaction accounts. The Dodd-Frank […]

Restoration of Depleted FDIC Deposit Insurance Fund Could Take 10 Years

October 19, 2010 – The FDIC announced today a long term Restoration Plan to return the Deposit Insurance Fund (DIF) to a positive balance. The long term goal of the proposed fund management plan is to maintain a positive fund balance, even “during periods of large fund losses, and maintaining steady, predictable assessment rates throughout economic […]

IMF – Risks To Real Estate And Banking Sector Remain Elevated

October 6, 2010 – The International Monetary Fund warned of elevated risks to global economies, real estate and the banking sector in its latest World Economic and Financial Survey. The IMF’s pessimistic outlook for economic recovery zeroed in on the risks associated with excessive levels of sovereign, commercial and household debt in an environment of […]

FDIC Says Dodd-Frank Act Ends “Too Big To Fail” Era

September 3, 2010 – FDIC Chairman Sheila Bair, in testimony before the Financial Crisis Inquiry Commission discussed how future systemic risks can be better managed and reduced under provisions of the Dodd-Frank Act. Chairman Bair also said that new liquidation authority under the Act is a fundamental factor that will allow the U.S. to end […]

Dodd-Frank Financial Regs Could Cripple Lending

August 13, 2010 – As the scope of the recently passed Dodd-Frank Act is assessed, many are convinced that the massive new regulatory burdens imposed by the new bill could cripple bank lending and restrain economic growth. Despite the good intentions of Congress, the unintended consequences of a massively complex and ambiguous financial reform bill […]

Bank Regulators Perplexed On How To Implement New Financial Regulations

August 13, 2010 – Congress quickly passed the massive 2,300 page Dodd-Frank Act which will profoundly reshape financial markets for years to come. Numerous federal regulators now have the immense job of writing hundreds of new regulations to enforce the bill’s sweeping mandates. Implementing and complying with the coming tidal wave of new regulations is […]

FDIC Creates New Divisions For Large Bank Failures And Consumer Protection

To order to carry out its responsibilities under the recently passed Dodd-Frank Wall Street Reform and Consumer Protection Act, the FDIC announced the creation of a new Office of Complex Financial Institutions (CFI) and Division of Depositor and Consumer Protection (DCP). The Dodd-Frank Act gave the FDIC authority to implement orderly liquidation of institutions designated […]

9,500 Uninsured Depositors Of Failed Banks To Be Reimbursed

The Dodd-Frank Wall Street Reform and Consumer Protection Act, signed into law by President Obama on July 21, 2010, permanently increases the deposit insurance limit to a maximum of $250,000. Deposit insurance limits had previously been temporarily increased from $100,000 to $250,000 effective from October 3, 2008, through December 31, 2010. The higher insurance coverage […]

Senate Passage of Regulatory Reform Bill Hailed As Milestone By FDIC

July 15, 2010 – New regulations for Wall Street and banks as well as broad new lending protection for consumers now awaits the President’s signature to become law. On a 60-39 vote, the Senate today passed the Dodd-Frank Wall Street Reform and Consumer Protection Act. The broad new powers given to regulators by the new bill was in response […]