The Federal Reserve Bank of Dallas joined the growing chorus of critics who maintain that the Dodd-Frank Act will not prevent future taxpayer funded bank bailouts. The Dallas Fed said taxpayers are still at risk for the cost of large banks failures and that any future bailouts should result in severe consequences for both bank management and bank creditors. According to Bloomberg,

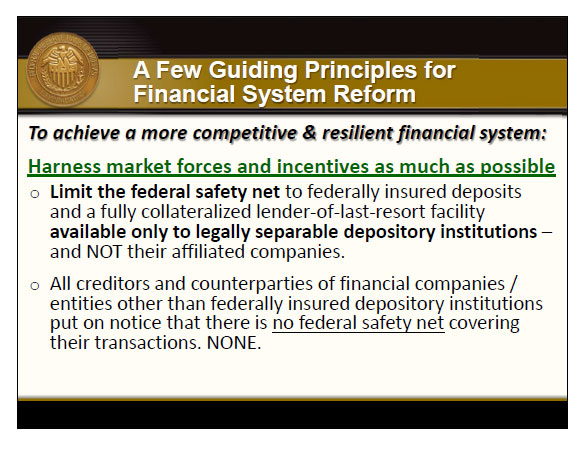

The Federal Reserve Bank of Dallas said taxpayer aid to failing banks should come only after the voiding of all employment and bonus contracts and the removal of chief executive officers and boards of directors.

“A set of harsh, non-negotiable consequences” for requesting U.S. Treasury assistance might also include “clawbacks” to gain cash and stock bonuses paid the top management team during the prior two years, the Dallas Fed said today in a slide presentation on its website.

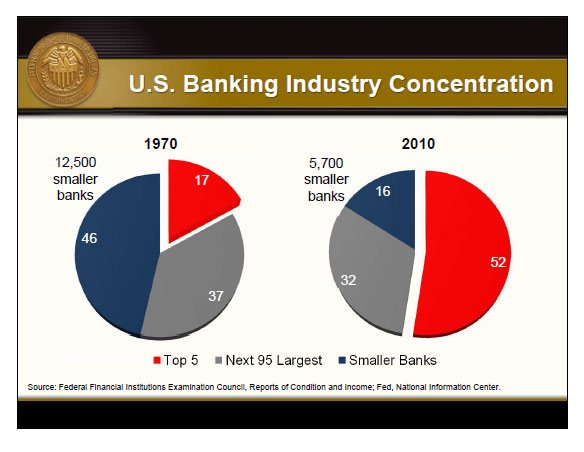

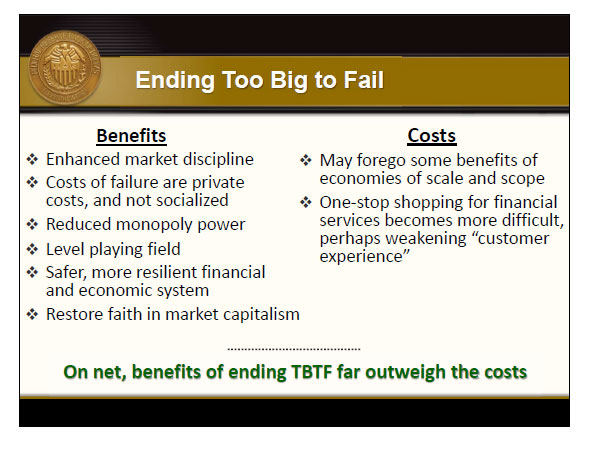

The proposal reflects Dallas Fed President Richard Fisher’s view that large U.S. banks need to be split apart because they operate with an implied government safety net that puts their risks of failure on taxpayers.

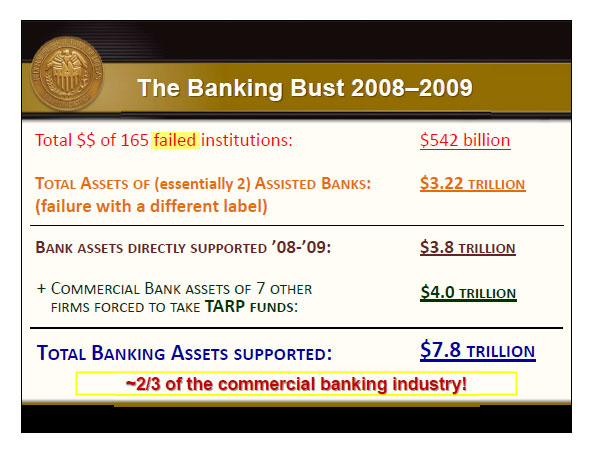

The “institutions that amplified and prolonged the recent financial crisis remain a hindrance to full economic recovery and to the very ideal of American capitalism,” Fisher said in an essay in the Dallas Fed’s 2011 annual report posted online.

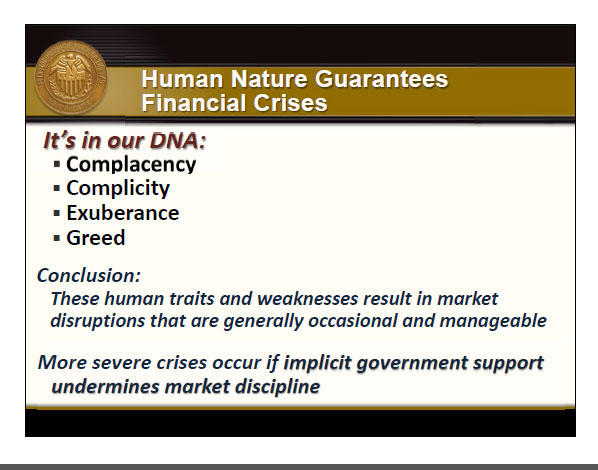

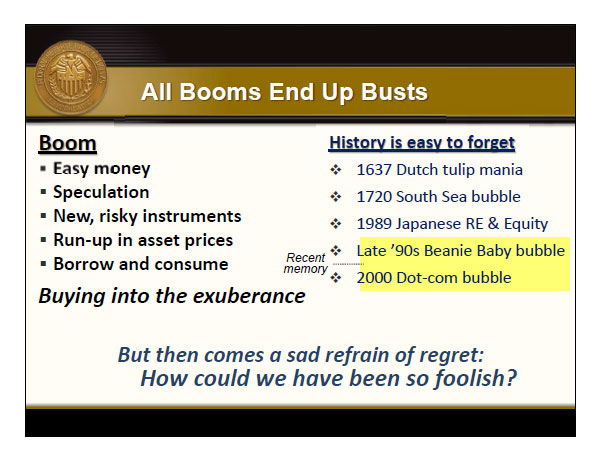

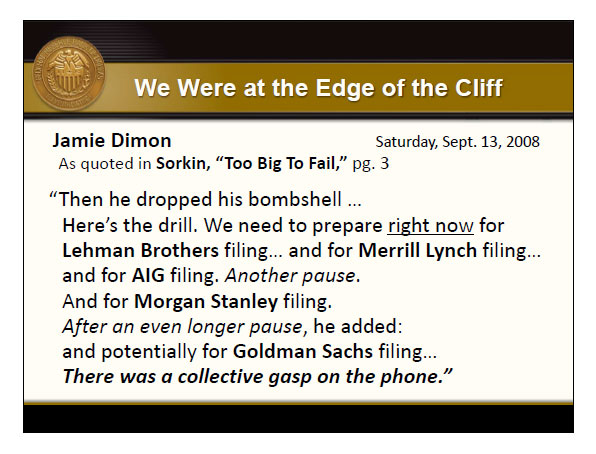

The Federal Reserve Bank of Dallas contends that if the implicit government guarantee to save the big banks undermines market discipline, the result could be severe financial crises. Selected pages from the Dallas Fed’s presentation entitled “Choosing the Road to Prosperity: Why We Must End Too Big To Fail – Now”, are shown below.

The presentation is a sober reminder of how close the financial system came to total collapse in 2008 and why we remain at risk for a potentially worse future crisis.

Speak Your Mind

You must be logged in to post a comment.