Welcome to Banking Update, a roundup of articles and news from around the Internet. Banks continue to be sued for selling defective mortgages, the Fed says a housing recovery is essential for economic recovery, Americans still believe owning a home is part of the “American dream”, banks are still engaged in risky behavior, savings rates are negative, European banks are still starved for funding, payday loans soar as millions live paycheck to paycheck, one pro sees continued tough economic times and the true health of the banking industry is impossible to ascertain. On to the links.

Requests for banks to buy back defective loans continues. Banks sold billions of dollars worth of mortgage securities during the housing boom to investors, subject to “reps and warranties” that gave buyers the right to put back defective loans to banks. The latest bank to face a buyback request due to alleged misrepresentations is JP Morgan which is being sued by US Bank, as trustee, for $95 million.

The Federal Reserve Chairman Bernanke, in a letter to the Senate Banking and House Financial Services Committees, said “Restoring the health of the housing market is a necessary part of a broader strategy for recovery.” The white paper accompanying the Chairman’s letter noted that:

The ongoing problems in the U.S. housing market continue to impede the economic recovery. House prices have fallen an average of about 33 percent from their 2006 peak, resulting in about $7 trillion in household wealth losses and an associated ratcheting down of aggregate consumption. At the same time, an unprecedented number of households have lost, or are on the verge of losing, their homes. The extraordinary problems plaguing the housing market reflect in part the effect of weak demand due to high unemployment and heightened uncertainty. But the problems also reflect three key forces originating from within the housing market itself: a persistent excess supply of vacant homes on the market, many of which stem from foreclosures; a marked and potentially long-term downshift in the supply of mortgage credit; and the costs that an often unwieldy and inefficient foreclosure process imposes on homeowners, lenders, and communities.

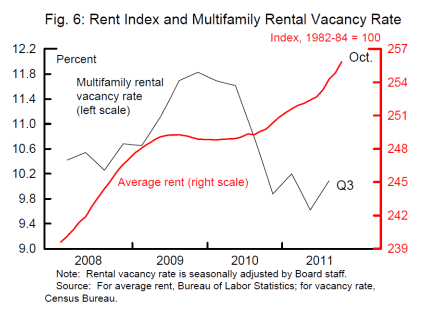

The Federal Reserve paper said that the decline in housing values was “unprecedented since the Great Depression” and has caused weak consumer spending and a loss of confidence. Despite the drop in home values, the rate of homeownership continues to decline causing an increase in rents as vacancy rates fall.

Americans still believe that owning a home is part of the American dream. According to a Yahoo survey, 74% of Americans think buying a home is a good investment but 42% said it is still too risky to actually buy a home now.

The Dodd-Frank Act did little to reduce risky behavior by banks. The New York Times proposes that the FDIC provide insurance on all deposits, without regard to size, which would decrease the risk of new banking panics.

More bad news for savers. Interest rates are actually negative resulting in a loss of real purchasing power for consumers.

European banks continue to borrow massive amounts of money from the European Central Bank. ECB lending has prevented a banking collapse, but will bank lending increase?

Payday loans, with very high interest rates are popular not only in the U.S. but also Great Britain. About one million people are forced to take payday loans to make ends meet until the next paycheck.

A recovery in housing is not likely without growth in jobs and income. One of the world’s most successful investment firms explains why they do not foresee an economic recovery for years.

The true financial health of major banks remains unclear. A lack of reporting transparency means that the real risk exposure of banks cannot be determined.

Speak Your Mind

You must be logged in to post a comment.