First Commercial Bank, Bloomington, MN, was closed today by the Minnesota Department of Commerce. The FDIC, which was named as receiver, sold the failed bank to Republic Bank & Trust Company, Louisville, KY. Founded in 1999, First Commercial Bank was a privately held company with total assets of $215.9 million as of June 30, 2012. […]

Banks Desperate For Funds Victimized By Con Men

This post should trigger a snicker from many consumers who feel that they are victims of the banking industry. In a new twist, banks themselves are now at the top of the list for many con men One would think that with the increased regulatory scrutiny of the banking industry, banks would be last on […]

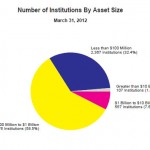

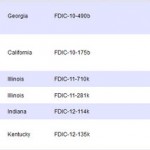

Five Bank Failures Bring Year’s Total To 38 – FDIC Losses Top $1.9 Billion

Regulators had a busy week closing five banks in four different states on Friday. Although bank failures have been proceeding at a slower pace than last year, the total losses to the FDIC Deposit Insurance Fund now top $1.9 billion and the number of problem banks remains very high considering that we are four years […]

The Royal Palm Bank of Florida Closed By Regualtors

The Royal Palm Bank of Florida, Naples, FL, was closed today by the Florida Office of Financial Regulation which appointed the FDIC as receiver. Opened in 2001, The Royal Palm Bank had served all of Southwest Florida through three offices in Collier & Lee counties, offering full service commercial banking services. In 2006, The Royal […]

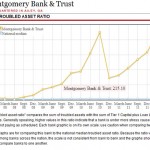

Montgomery Bank & Trust, Georgia, Closed By Regulators

Montgomery Bank & Trust, a long time presence in Ailey, Georgia, was closed today by the Georgia Department of Banking and Finance. Montgomery Bank and Trust, which had been in business since 1926, became insolvent after a large amount of borrowers defaulted on their loans. The FDIC was appointed as receiver and sold the failed […]