The Barclays Libor scandal continues to escalate after revelations that senior officials at the Bank of England pressured Barclays to artificially lower the Libor rate. Documents released by Barclays suggest that U.K. treasury officials pressured Barclays to lower the Libor rate. This latest development threatens to turn the Libor rate fixing scandal into a showdown between Barclays and the Bank of England over who was responsible for the rate fixing.

The motive for the Bank of England to pressure Barclays into artificially lowering the Libor rate during the financial crisis of 2008 was to make it appear that the U.K. banking industry was healthier than it really was. Banks forced to pay higher Libor rates would have been considered at high risk which might have exacerbated the banking crisis.

Barclays has come under heavy criticism from the public, politicians and shareholders for its role in the rate fixing scandal and three top executives of the Bank have resigned in recent days. Bank Chairman Marcus Agius resigned shortly after news of the scandal broke, followed by the resignations of CEO Robert Diamond and Chief Operating Officer Jerry del Missier.

Resignations may not turn out to be the end of the story for bank executives since U.K. regulators are considering starting a criminal probe regarding Barclays actions in the Libor scandal. As reported on Bloomberg TV, former Barclays CEO Robert Diamond will be questioned today by members of the Treasury Select Committee on the role of the Bank of England in the Libor scandal.

Barclays Bank is one of the world’s largest banks with $2.5 trillion in total assets. By comparison the Bank of America has approximately $2.2 trillion in total assets.

Moody’s Investors Service recently downgraded Barclays credit rating by two notches to A2, which is still an investment grade. However, Moody’s cut the “stand-alone” credit rating of Barclays to a speculative grade of C-/baa2, indicating that the bank is at a high risk of failure without government financial support. Barclays is simply too big to fail and is one of many very large problem banks in Europe that have avoided collapse only by virtue of massive government financial support.

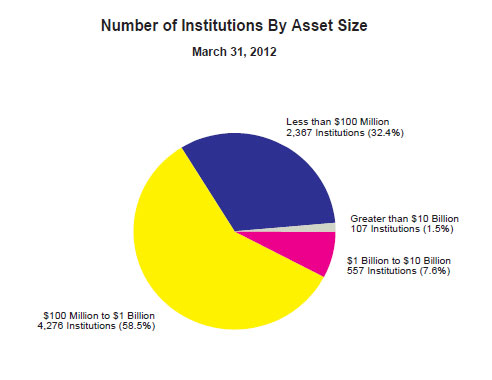

In addition to the $455 million settlement for the Libor scandal, Barclays is potentially facing another fine of as much as $785 million relating to charges of evading taxes. The massive total potential liability of $1.24 billion is larger than the total assets of 90% of the U.S. banks insured by the FDIC.

Source: FDIC

If Barclays financial health is impaired by payment of $1.24 billion, the U.K. government will be forced to step in to avert a collapse of the bank. Barclays stand alone credit rating indicates that the bank would fail without government support, meaning that the financial penalties imposed on Barclays will ultimately be shouldered by British taxpayers.

Speak Your Mind

You must be logged in to post a comment.