The Royal Palm Bank of Florida, Naples, FL, was closed today by the Florida Office of Financial Regulation which appointed the FDIC as receiver. Opened in 2001, The Royal Palm Bank had served all of Southwest Florida through three offices in Collier & Lee counties, offering full service commercial banking services. In 2006, The Royal Palm Bank was acquired by Mercantile Bancorp, Inc., a community bank holding company that owns six banks.

The Royal Palm Bank of Florida, Naples, FL, was closed today by the Florida Office of Financial Regulation which appointed the FDIC as receiver. Opened in 2001, The Royal Palm Bank had served all of Southwest Florida through three offices in Collier & Lee counties, offering full service commercial banking services. In 2006, The Royal Palm Bank was acquired by Mercantile Bancorp, Inc., a community bank holding company that owns six banks.

The FDIC, acting as receiver, sold The Royal Palm Bank to First National Bank of the Gulf Coast, Naples, FL. All deposits of The Royal Palm will be assumed by First National Bank and all depositors of The Royal Palm will automatically become depositors of First National Bank. Full FDIC insurance coverage up to applicable limits will continue in force for depositors of the failed bank.

The three offices of The Royal Palm Bank will reopen on Monday as branches of First National Bank. Over the weekend, depositors of The Royal Palm Bank will have full access to their money through the use of checks, ATM and debit cards.

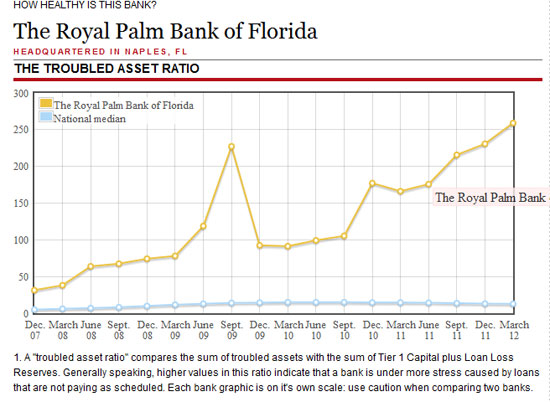

The Royal Palm Bank had been struggling under the weight of nonperforming loans since mid 2009 and the Bank’s troubled asset ratio escalated dramatically since late 2010 to 259% at March 31, 2012. Banks with a troubled asset ratio in excess of 100% rarely wind up surviving and The Royal Bank was no exception to this rule. The Royal Palm Bank has been a problem bank for years, a situation that regulators have been aware of. The Bank was issued a Cease and Desist Order on May 20, 2009, which detailed numerous “unsafe or unsound banking practices alleged to have been committed by the Bank.”

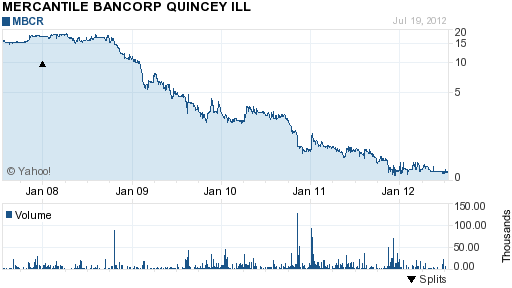

Mercantile Bancorp, the holding company for The Royal Palm Bank, announced on May 2, 2012 that they had reached an agreement to sell The Royal Bank to Encore National Bank, Naples, Florida, subject to regulatory approval. The sale of the Bank was never completed. Mercantile Bancorp continues to struggle with its poorly performing collection of banks. Mercantile Bancorp, Inc.’s stock barely has a pulse, closely today at 19 cents a share.

courtesy yahoo finance

The Royal Palm Bank was a small bank. At March 31, 2012, the Bank had total assets of $87.0 million and total deposits of $85.1 million. In addition to assuming all deposits, First National Bank also purchased essentially all of The Royal Palm Bank’s assets. First National Bank of the Gulf Coast is a well capitalized Bank with total assets of $460 million. The acquisition of The Royal Palm Bank was the first acquisition of a failed bank by The First National Bank.

The loss to the FDIC Deposit Insurance Fund for the failure of The Royal Palm Bank of Florida is $13.5 million. The Royal Palm Bank is the nation’s 34th banking failure of the year and the 5th in Florida.

Speak Your Mind

You must be logged in to post a comment.