Montgomery Bank & Trust, a long time presence in Ailey, Georgia, was closed today by the Georgia Department of Banking and Finance. Montgomery Bank and Trust, which had been in business since 1926, became insolvent after a large amount of borrowers defaulted on their loans.

Montgomery Bank & Trust, a long time presence in Ailey, Georgia, was closed today by the Georgia Department of Banking and Finance. Montgomery Bank and Trust, which had been in business since 1926, became insolvent after a large amount of borrowers defaulted on their loans.

The FDIC was appointed as receiver and sold the failed bank to Ameris Bank, Moultrie, Georgia, which will assume all deposits of failed Montgomery Bank & Trust. Both branches of Montgomery Bank & Trust will reopen on Monday as branches of Ameris and all depositors of Montgomery Bank will automatically become depositors of Ameris Bank.

Montgomery Bank & Trust, established in 1926, used the pineapple as their corporate logo. According to the Bank’s website, the pineapple “is a widely recognized symbol of hospitality and warm welcome.” Montgomery Bank occupied the same offices in Ailey, Georgia, for 64 years until moving to a new location in 1970 which was located one block from its old location. It wasn’t until 1996 that the Bank opened a second branch.

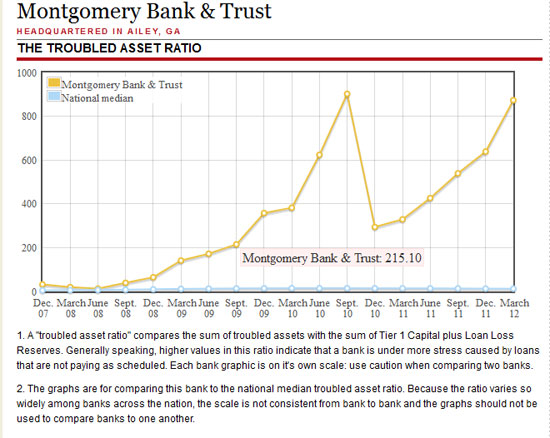

Despite the sedate nature of the Bank’s history, Montgomery Bank & Trust rapidly expanding their lending activities during the real estate boom and assets doubled in the five years prior to the real estate crash and financial panic of 2008. What appeared to be sound loans to good borrowers turned into a mountain of nonperforming loans.

At March 31, 2012, Montgomery Bank had an extremely high troubled asset ratio of 873%. Most banks usually fail once the troubled asset ratio exceeds 100%.

On October 6, 2009, the Bank was issued a Cease and Desist Order from the FDIC for “unsafe or unsound banking practices and violations of law and/or regulations alleged to have been committed by the Bank.” Unable to raise additional capital and swamped with bad loans, regulators had no option but to close this problem bank.

Depositors of failed Montgomery Bank & Trust will have full access to their money over the weekend through the use of checks, ATMs and debit cards.

At March 31, 2012, Montgomery Bank had total assets of $173.6 million and total deposits of $164.4 million. The asset quality of loans made by Montgomery Bank was apparently so poor that Ameris Bank agreed to purchase only $12.4 million in assets of the failed bank and those assets essentially consisted of cash and cash equivalents. The FDIC will retain over $160 million in assets from Montgomery Bank which it will add to its already huge portfolio of failed bank assets (see The FDIC Has A $30 Billion Junk Loan Problem). The failed bank assets will be classified on the FDIC’s balance sheet as “resolution receivables balance” which as of March 31, 2012 totaled $29 billion.

Ameris Bank, owed by holding company parent Ameris Bancorp has now acquired 10 failed banks since October 2009 including today’s purchase of Montgomery Bank & Trust. Ameris Bancorp, which had borrowed $52 million under the TARP program, recently repaid almost all of the loan when it made a payment of $47.7 million in June 2012.

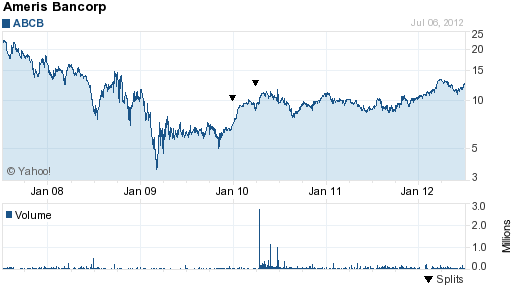

Ameris Bancorp has over $3 billion in total assets and is profitable. The stock of Ameris Bancorp has tripled from its low of $4 per share in early 2009.

Courtesy yahoofinance.com

The loss to the FDIC Deposit Insurance Fund for the failure of Montgomery Bank & Trust is $75.2 million, a substantial 43% of Montgomery Bank’s total assets. The average loss to the FDIC for the previous 31 bank failures of 2012, expressed as a percentage of the failed banks total assets was 22%.

Montgomery Bank & Trust is the nation’s 32nd banking failure of 2012 and the sixth in Georgia.

Speak Your Mind

You must be logged in to post a comment.