Montgomery Bank & Trust, a long time presence in Ailey, Georgia, was closed today by the Georgia Department of Banking and Finance. Montgomery Bank and Trust, which had been in business since 1926, became insolvent after a large amount of borrowers defaulted on their loans. The FDIC was appointed as receiver and sold the failed […]

Ridiculous Divergence Between Bank CEO Pay And Shareholder Returns

The wide divergence between bank CEO compensation and shareholder returns is an embarrassment to the capitalist notion of linkage between performance and pay. Shareholders of banking stocks have seen the value of their investments pulverized over the past four years as the banking industry struggles to recover from the lending excesses of previous years. Shareholders […]

Credit Ratings of 15 Global Banks Cut In Largest Downgrades Since 2007

In the most sweeping credit downgrades since 2007, Moody’s Investor Service lowered the credit ratings of fifteen global banks, including the five largest banks in the United States. The scope of the credit downgrades left many wondering if we are entering a new phase of the global financial meltdown that started in 2008. Despite trillions […]

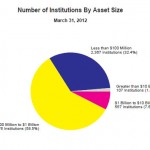

Three Banks Fail In Tennessee, Georgia and Florida – Total 2012 Bank Failures At 31

Regulators closed three banks in three different states, as loan losses continue to plague the banking industry. Efforts by small banks to raise additional capital have become increasing difficult due to low loan demand, a slowing economy and investor antipathy towards banking stocks. The latest three banking failures in Tennessee, Georgia and Florida bring total […]

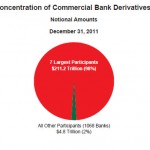

Banks Amass $211 Trillion In Derivatives, JP Morgan Loses $2 Billion And Volcher Rule Debates Continue

The goal of the Volcker Rule, which became law under the Dodd-Frank Act was to restrict speculative trading activity in risky derivatives by the Too Big To Fail Banks. The ban on proprietary bank trading was proposed by former Federal Reserve Chairman Paul Volcker who believed that one of the primary causes of the 2008 […]

Dallas Fed Says “Too Big To Fail Banks” Should Be Broken Up – Future “Severe Crises” Possible

The Federal Reserve Bank of Dallas joined the growing chorus of critics who maintain that the Dodd-Frank Act will not prevent future taxpayer funded bank bailouts. The Dallas Fed said taxpayers are still at risk for the cost of large banks failures and that any future bailouts should result in severe consequences for both bank […]