The FDIC today released an update on expected losses for banking failures through 2015. For the five year period 2011 through 2015 the FDIC is forecasting total losses from banking failures of $19 billion. Total losses from banking failures during 2010 were $23 billion compared to $6.4 billion in 2011 year to date losses. A […]

FDIC Forecasts $19 Billion In Losses On Banking Failures – Why The Losses Will Be Five Times Larger

European Banking Crisis Spins Out Of Control – Officials Have No Solutions

The European banking crisis intensified as the threat of debt default contagion spread across Europe. What was once a “Greek” problem has quickly overwhelmed all of Europe, resulting in a broad sell of equities and frozen credit markets. Bloomberg reports that European banks are now being valued at levels last seen during the worst of […]

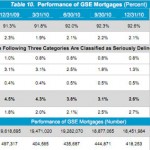

Regulators Say Banks Have 20% Delinquency Rate On $2.6 Trillion Mortgage Portfolio

Who says the mortgage crisis is over? Regulators revealed today that the nation’s banks and thrifts have an alarming delinquency rate of almost 20% on their $2.6 trillion mortgage portfolio. The Office of the Comptroller of the Currency and the Office of Thrift Supervision jointly released the 2011 first quarter Mortgage Performance Report. The Report […]

Downward Spiral Of Bank Stocks Is Predicting An Economic Crisis

After rallying last fall, many of the big bank stocks have seen substantial declines from the beginning of the year. Growing fears about the health of the banking industry are discussed in the latest Economics and Mortgage Market Analysis issued by Fannie Mae. Fannie Mae cites a very weak housing market and an economic slowdown […]

FDIC 2010 Third Quarter Banking Profile

Today, the FDIC released its latest quarterly banking profile, which highlighted an increase in earnings for FDIC-insured institutions. For the third quarter of 2010, commercial banks and savings institutions insured by the FDIC reported aggregate profits of $14.5 billion compared to only $2 billion in the year ago period. However, the results did represent a […]