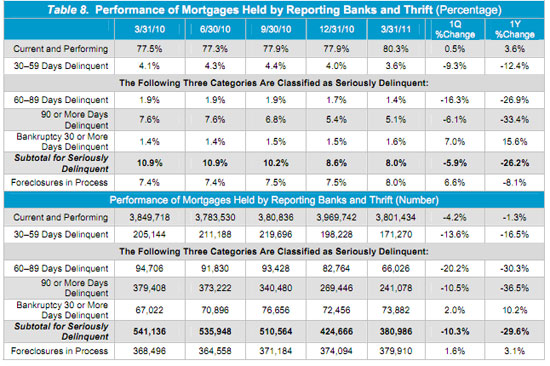

Who says the mortgage crisis is over? Regulators revealed today that the nation’s banks and thrifts have an alarming delinquency rate of almost 20% on their $2.6 trillion mortgage portfolio.

The Office of the Comptroller of the Currency and the Office of Thrift Supervision jointly released the 2011 first quarter Mortgage Performance Report. The Report provides an in depth analysis on $5.7 trillion of outstanding first mortgages, representing 63% of all first mortgages in the United States.

According to regulators only 80.3% of all bank and thrift held mortgages are current compared to 88.6% of all reported mortgages. Regulators said that the elevated delinquency rate of 19.7% was due to an over concentration in risky nonconforming mortgages geographically concentrated in weaker real estate markets. The banks not only managed to pack their mortgage portfolios with risky loans, but also managed to write loans in areas that had the largest decline in real estate values.

In addition to a massively delinquent first mortgage portfolio, banks also hold about $760 million in second mortgages. Most banks have not provided specific data on their second mortgage portfolio, but the large decline in real estate values has rendered many second mortgages effectively worthless. The relentless decline in housing values further erodes the value of second mortgages. Despite recent reductions or reversal of loan loss reserves, it is highly likely that many banks are severely under reserved for future losses on both first and second mortgages, barring a miraculous recovery of both the housing and job markets.

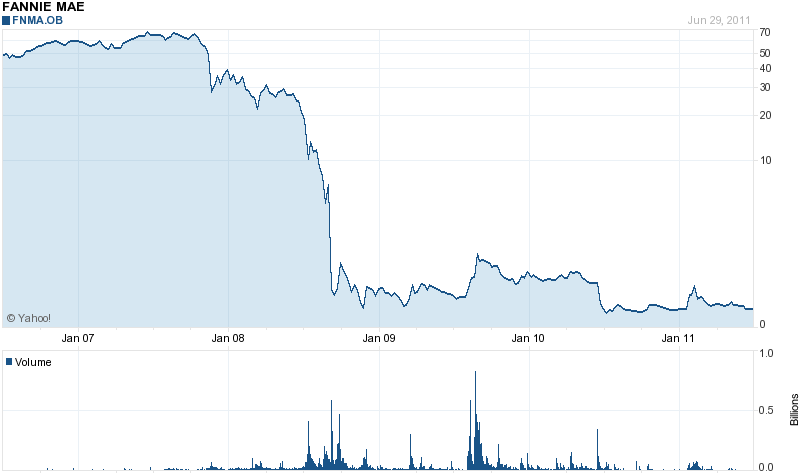

Ironically, the regulators report that the performance of GSE mortgages held by Fannie Mae and Freddie Mac have a very low rate of default compared to mortgages owned by banks and thrifts. Fannie and Freddie, both currently in government receivership, have a default rate of 6.8% which is 300% better than the performance of bank owned mortgages. Regulators ascribe the better performance of Fannie and Freddie mortgages due to holding a greater percentage of prime loans.

Fannie and Freddie have a long way to go before they return to solid profitability, but perhaps long suffering investors in stocks such as Bank of America should consider a “lottery ticket” investment in Fannie Mae or Freddie Mac.

Bankers took ridiculous risks to achieve the largest paychecks. Lending without regard to risk and common sense underwriting guidelines has caused massive losses for both bank shareholders and the taxpayers.

Alan Greenspan, former Federal Reserve Chairman, said recently in an interview with Charlie Rose in Bloomberg Businessweek that “One of the things that I had been almost taking as a given was that corporate executives, specifically bank executives, knew enough about their organizations and cared enough to act in support of the solvency of their institutions. I was wrong. They did not.”

The FDIC is fraudulent! When Glass-Steagall Act was repealed it was necessary that FDIC be revoked, at which point the public would have been notified of the reasons for the act and consequences it was meant to prevent! The necessary action to revoke FDIC was purposely and deceptively withheld from public notice by politicians, by banks, and by the FDIC itself!……

With the passage of the Glass-Steagall Act in 1933, after the 1929 stock market crash, commercial and investment banking were separated. The FDIC was founded with an understanding that it could underwrite (insure) the commercial deposits because those funds were not being used for speculation! However, when the Glass-Steagall Act was repealed in 1996 by the Gramm- Leachy-Bliley Act (money weight-leech-pirate act), investment banking was provided access to commercial deposits. FDIC underwriting specifically prohibits use of commercial deposits for financial investment assets and is not obligated to cover the losses!

Further, if one had placed their commercial deposits in financial risk markets, the rate of returns would have been appreciably greater than the trivial interest rates on commercial deposits…….Investment institutions deceptively usurped FDIC restrictions, which allowed the banks to profit illegally and profoundly. In addition, banks destroyed the US and global economic systems by pervasively acquiring every resource of capital available, even multiplying those capital resources through fractional lending! The US taxpayer and US government are therefore obligated and entitled to seek liabilities and damages against the responsible individuals that are responsible for the catastrophe……….Thus, not only should FDIC not pay out those funds – force the issue!! ….

The politicians who purposely and deceptively failed to revoke FDIC, with the implementation of the Gramm-Leachy-Bliley- Act, should be impeached for malfeasance!…….. The assets for the lobbying financial institutions, which corroborated to assist in the espionage and financial terrorism, should be seized and their institutions incarcerated as individuals. All responsible individuals should be held to account and fined to pay for the damage.

In 1929 a special district attorney was assigned to investigate the crash and many were prosecuted! Now, +70 years later, the political environment for such prosecutions are a ridiculous joke! The US citizens do not need the permission of government to prosecute these criminals under a grand jury! Appoint a presiding lawyer and convene a grand jury! Prosecute the government officials if they get in the way!

http://www.debatepolitics.com/blogs/monk-eye/179-call-all-support-impeachments-and-class-action-lawsuits.html