The latest FDIC Quarterly Banking Profile highlights the sharp decline in the number of banks over the past 24 years. For the quarter ending September 30, 2014 the number of FDIC insured institutions totaled 6,589 down by 56 percent from a total of 15,158 in 1990. Since December 1998 the number of banks has dropped […]

Over 8,500 Banks Have Disappeared Since 1990 – “Too Big to Fail” Remains a Banking Reality

Would Bank Living Wills/Resolution Plans Actually Help Resolve the Next Banking Crisis?

The public portions of the annual resolution plans or living wills of 17 large financial institutions were jointly released by the FDIC and the Federal Reserve Board today. The resolution plans describe in detail a financial institution’s plans for a rapid and orderly resolution under the U.S. Bankruptcy Code to address material financial distress or […]

Two U.S. Banks Included In “The World’s 20 Strongest Banks”

A short number of years ago the “too big to fail banks” had to be bailed out with trillions of dollars in financial aid from both the taxpayers and the Federal Reserve. At one point there were serious discussions about nationalizing the entire U.S. banking industry. As a sign of how rapidly America’s largest banks […]

Bank of America Has Built a “Fortress Balance Sheet”

A short number of years ago, no one in his right mind would have associated the term “fortress balance sheet” with Bank of America. During the financial crisis, Bank of America was forced to accept a massive $45 billion bailout from the U.S. Treasury. As the financial system imploded during 2008 many people wondered if […]

Freddie Mac Stock Jumps On Earnings – What’s Next For Shareholders?

Freddie Mac (FMCC), the government sponsored agency that backs mortgage loans for millions of American home buyers reported all time record annual profit of $11 billion for 2012. Freddie Mac has been in the black now for five consecutive quarters as the housing market improves and loan delinquencies decrease. Freddie Mac has been operating under […]

Why Banks Will Continue To Blow Up

Although there were a multitude of factors involved in the banking collapse of 2008, many analysts believe that the repeal of Glass-Steagall was one of the major triggers. No less an authority than Sandy Weill, former Citigroup CEO, joined the chorus of voices last week in calling for the reinstatement of the Glass-Steagall Act. Would […]

Banks Are A Financial Disaster For Both Shareholders And Depositors

In days gone by, shareholders of large banks viewed their investments as a source of income via dividends and potential capital gains via share appreciation. In days gone by, depositors viewed banks as the safest place to harbor their hard earned dollars while earning a respectable amount of interest income. That was then, this is […]

Credit Ratings of 15 Global Banks Cut In Largest Downgrades Since 2007

In the most sweeping credit downgrades since 2007, Moody’s Investor Service lowered the credit ratings of fifteen global banks, including the five largest banks in the United States. The scope of the credit downgrades left many wondering if we are entering a new phase of the global financial meltdown that started in 2008. Despite trillions […]

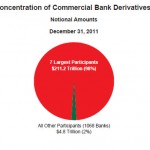

Banks Amass $211 Trillion In Derivatives, JP Morgan Loses $2 Billion And Volcher Rule Debates Continue

The goal of the Volcker Rule, which became law under the Dodd-Frank Act was to restrict speculative trading activity in risky derivatives by the Too Big To Fail Banks. The ban on proprietary bank trading was proposed by former Federal Reserve Chairman Paul Volcker who believed that one of the primary causes of the 2008 […]