David Stockman, former budget director in the Reagan administration, argues persuasively that the fundamental problems of the financial system are worse than in 2008. The “too big to fail” banks have become bigger, politicians have been bought and paid for, an entitled class of Wall Street financiers are being served by government policies and a […]

Too Big To Fail Banks Get Bigger – Fundamental Financial Problems Worse Than 2008

Increase In Third Quarter Banking Profits Largely Due To Phony Accounting Gimmicks

The FDIC’s Quarterly Banking Profile for the third quarter of 2011 shows banking industry profits increasing by 48% from the third quarter of 2010. Aggregate net income of the banking industry for the third quarter of 2011 totaled $35.3 billion compared to $23.8 billion in the third quarter of 2010. Although traditional news organization headlines proclaimed “Strong Profit Growth […]

New FDIC Vice Chairman May Seek To Break Up Big Banks

Will the “too big to fail” banks that pose a systemic risk to the financial system ever be broken up? If Thomas Hoenig, former Kansas City Fed president wins Senate nomination as the new Vice Chairman of the FDIC, the big banks may have a lot to worry about. Mr. Hoenig should easily win Senate […]

Why Are We Having Nonstop Financial Crises?

Issuing a sell opinion on a bank stock is usually a short route to oblivion for a banking analyst. Mike Mayo is one banking analyst who did issue sell opinions on banks yet managed to survive. In his new book, “Exile on Wall Street”, banking analyst Mike Mayo provides an insider’s view on why the […]

29 Banks That Could Destroy The Global Economy

The Financial Stability Board (FSB) was established to coordinate international efforts to promote effective regulation and supervision of the global financial system. In its latest report on global systemically important banks, the FSB makes it clear that the world’s largest banks have become too big to fail without crashing the global economy. The leaders of […]

Too Big To Fail Casino Banks Make $518 Billion Bet On PIIGS Sovereign Debt

The “Too Big To Fail Banks” are at it again, making huge speculative bets on the odds of sovereign default by Portugal, Italy, Ireland, Greece and Spain. The costly lessons of the derivatives debacle of 2008 have apparently been forgotten. In 2008, the Too Big To Fail banks bought massive amounts of credit default swaps […]

Bank Of America Derivatives Timebomb Shows System Is Corrupt To The Core

The Federal Reserve recently allowed Bank of America to move its massive derivative positions from the bank holding company to its banking subsidiary which is an FDIC insured depository institution. By allowing this transfer, the Federal Reserve has allowed Bank of America to shift the risk of loss on speculative derivative contracts from the non-bank […]

FDIC To Cover Losses On $75 Trillion Bank of America Derivative Bets

Potential losses on Bank of America’s massive $75 trillion book of risky derivative contracts has just been dumped onto the FDIC by the Federal Reserve. Derivatives, once described by Warren Buffet as “financial weapons of mass destruction” are complex contracts entered into for speculation or to hedge risks linked to a wide variety of other […]

Global Financial System Faces Worldwide Bank Runs and Failures, Citigroup’s $300 Billion Problem

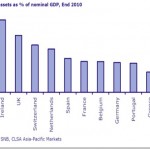

Three years after the height of the financial crisis, the issue of impaired assets on bank balance sheets remains a major risk to the health of the banking system. Regulators have allowed banks to avoid taking losses on impaired assets by not requiring mark to market accounting. The extent of overvaluation on bank loans can […]