The Financial Stability Board (FSB) was established to coordinate international efforts to promote effective regulation and supervision of the global financial system.

In its latest report on global systemically important banks, the FSB makes it clear that the world’s largest banks have become too big to fail without crashing the global economy.

The leaders of the G20 recently requested the FSB to develop a policy framework to evaluate the risks associated with “systemically important financial institutions” (SIFIs). In its report to the G20, the FSB states that :

SIFIs are financial institutions whose distress or disorderly failure, because of their size, complexity and systemic interconnectedness, would cause significant disruption to the wider financial system and economic activity. To avoid this outcome, authorities have all too frequently had no choice but to forestall the failure of such institutions through public solvency support. As underscored by this crisis, this has deleterious consequences for private incentives and for public finances.

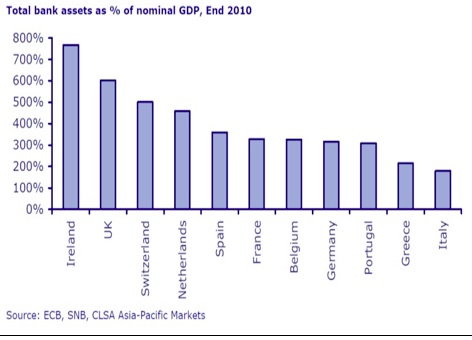

Although the FSB has established a set of policies for dealing with “too big to fail” institutions, none of the measures have been instituted. The largest banks have been allowed to grow so large that their size has overwhelmed the ability of nation’s to bail them out without destroying national balance sheets. Who is left to rescue banks that have become bigger than countries!?

The 29 most dangerous banking institutions (SIFIs) identified by the FSB are listed below. The FSB blandly admits that the sudden failure of even one of these huge banks could result in “contagion risk” that would topple the entire interlocked financial system. Not surprisingly, U.S. banks are prominent on the list, including Bank of America, Citigroup, Goldman Sachs, JP Morgan Chase, Morgan Stanley and Wells Fargo.

Bank of America

Bank of China

Bank of New York Mellon

Banque Populaire CdE

Barclays

BNP Paribas

Citigroup

Commerzbank

Credit Suisse

Deutsche Bank

Dexia

Goldman Sachs

Group Crédit Agricole

HSBC

ING Bank

JP Morgan Chase

Lloyds Banking Group

Mitsubishi UFJ FG

Mizuho FG

Morgan Stanley

Nordea

Royal Bank of Scotland

Santander

Société Générale

State Street

Sumitomo Mitsui FG

UBS

Unicredit Group

Wells Fargo

Monetary Reform Act – A Summary(in four paragraphs)This proposed law would require banks to increase their reserves on deposits from the current 10%, to 100%, over a one-year period. This would abolish fractional reserve banking (i.e., money creation by private banks) which depends upon fractional (i.e., partial) reserve lending. To provide the funds for this reserve increase, the US Treasury Department would be authorized to issue new United States Notes (and/or US Note accounts) sufficient in quantity to pay off the entire national debt (and replace all Federal Reserve Notes).The funds required to pay off the national debt are always closely equivalent to the amount of money the banks have created by engaging in fractional lending because the Fed creates 10% of the money the government needs to finance deficit spending (and uses that newly created money to buy US bonds on the open market), then the banks create the other 90% as loans (as is explained on our FAQ page). Thus the national debt closely tracks the combined total of US Treasury debt held by the Fed (10%) and the amount of money created by private banks (90%).Because this two-part action (increasing bank reserves to 100% and paying off the entire national debt) adds no net increase to the money supply (the two actions cancel each other in net effect on the money supply), it would cause neither inflation nor deflation, but would result in monetary stability and the end of the boom-bust pattern of US economic activity caused by our current, inherently unstable system.Thus our entire national debt would be extinguished – thereby dramatically reducing or entirely eliminating the US budget deficit and the need for taxes to pay the $400+ billion interest per year on the national debt – and our economic system would be stabilized, while ending the terrible injustice of private banks being allowed to create over 90% of our money as loans on which they charge us interest. Wealth would cease to be concentrated in fewer and fewer hands as a result of private bank money creation. Thereafter, apart from a regular 3% annual increase (roughly matching population growth), only Congress would have the power to authorize changes in the US money supply – for public use -not private banks increasing only private bankers’ wealth.This is how tax payers can take control!!! Thank you Mr. & Mrs. Freidman