With hundreds of bank failures over the past four years and the Problem Bank List at a 20 year high, it is sometimes easy to get the impression that all banks were engaged in reckless lending during the real estate bubble years. While virtually all of the “Too Big To Fail Banks” engaged in highly […]

Not All Banks Made Poor Lending Decisions During The Bubble Years – 5 Banks Worth Buying

Bank of America’s Stock Is A “Great Value” and Housing Will Come Back

It is always wise to pay attention to one of the greatest investment minds of all time. In the most recent letter to shareholders of Berkshire Hathaway, legendary investor Warren Buffet makes the case for a recovery of both the housing market and shares of Bank of America. Warren Buffet has shown time and again […]

Banks Tell 30 Million Troubled Customers To Get Lost – One In Three Consumers Now “Unbanked”

How does the average consumer get by without a basic checking account? How does someone without a checking account pay the bills that arrive each month – drive around to each creditor and pay in cash? Where do you keep your savings – under the mattress or buried in the back yard? As incredible as […]

Why Bank Stocks Are Impossible To Analyze or Value

During 2012, investor fears about the financial condition of banks resulted in the biggest decline in bank stocks since the financial crash of 2008. A weakening economy and fears about massive exposure to insolvent European financial institutions sent bank investors running to the exits. The brutal sell off in banking stocks during 2012 can be […]

Foreclosure Settlement Q&A – Who Wins, Who Loses – A Victory For The Irresponsible

A $25 billion foreclosure settlement reached between the government and the big banks has many wondering who will win and who will lose among the different parties involved. Although the settlement is complicated and will take years to work out, the basic framework will please some and annoy others. Here are some basic questions and […]

Foreclosure Inventory Near Record Highs, Attempts To Slow Foreclosures Is Prolonging The Housing Crisis

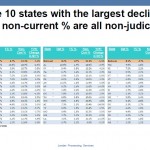

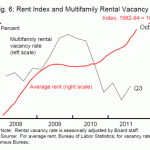

LPS Mortgage Monitor has come out with a comprehensive series of charts including the current level of foreclosures, delinquencies by year of origination, length of time homeowners have not made a payment in judicial states, states with largest drops in non-current mortgages and foreclosure rates in judicial vs non judicial states. The states with the […]

Everyone and No One Is In Charge Of Fixing The Housing Crisis

The housing crisis is widely viewed as the biggest impediment to economic recovery. Despite the expenditure of trillions of dollars in financial support from the Federal Reserve and other government agencies, housing prices continue to decline. In addition, the wide ranging regulatory overhaul of banking and mortgage practices being implemented under the Dodd-Frank Act, is […]

Major Mortgage Lender Calls It Quits – Mortgages Become A Losing Proposition For Banks

While the Federal Reserve and other government agencies urge banks to lower credit standards and increase lending, one major mortgage lender is calling it quits due to onerous regulatory burdens that increase lending risks and reduce profits. MetLife, the country’s largest insurance company, is closing its $20 billion mortgage operations and firing 4,300 employees. The […]

Banking News – Daily Banking Update

Welcome to Banking Update, a roundup of articles and news from around the internet. The Federal Reserve’s political moves threaten its independence, loan modification companies prey on vulnerable homeowners, the big banks refuse to disclose their risk on derivatives, consumers want to be bailed out for foolish financial decisions, loss of confidence in governments grow […]

Banking News – Daily Banking Update

Welcome to Banking Update, a roundup of articles and news from around the Internet. Banks continue to be sued for selling defective mortgages, the Fed says a housing recovery is essential for economic recovery, Americans still believe owning a home is part of the “American dream”, banks are still engaged in risky behavior, savings rates […]