With hundreds of bank failures over the past four years and the Problem Bank List at a 20 year high, it is sometimes easy to get the impression that all banks were engaged in reckless lending during the real estate bubble years.

With hundreds of bank failures over the past four years and the Problem Bank List at a 20 year high, it is sometimes easy to get the impression that all banks were engaged in reckless lending during the real estate bubble years.

While virtually all of the “Too Big To Fail Banks” engaged in highly leveraged and risky lending practices that contributed to the financial and banking crash of 2008, many prudent smaller lending institutions remained committed to sound banking practices.

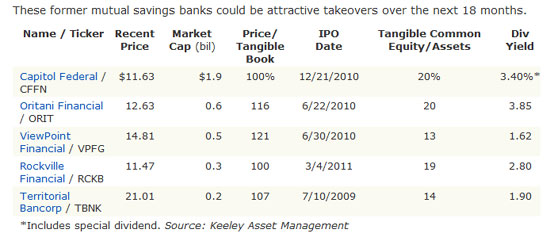

This week’s Barron’s interviewed Mark Zahorik, a portfolio manager at Keely Asset Management in Chicago, who shared his thoughts on investment opportunities in the banking sector.

Mr. Zahorik argues that depositor owned mutual savings banks which have converted to common stock ownership have characteristics that make many of them attractive acquisition targets for larger banks. Supporting this theory is the fact that since 1990, over 66% of banks that converted to common stock ownership were subsequently bought out.

The primary reason former mutual savings banks are taken over by larger banks is simple. The mutual savings banks retained a basic banking business model – take in deposits and make fundamentally conservative loans. Due to sound banking practices, these banks have few problem loans, hold excess capital, usually pay dividends and have solid price to book ratios.

Given the slow rate of loan growth in the U.S. banking system, larger banks wishing to expand see acquisitions as one of the few sound options for growth. One caveat that Mr. Zahorik mentions is that by law, demutualized savings banks can’t be taken over until 3 years after the date they go public.

According to Mr. Zahorik, most of the takeovers are done at 1.5 times book value which could mean a hefty premium for shareholders of the banks recommended by Mr. Zahorik listed below.

At a time when the Federal Reserve has used financial repression to crush savers, these banks not only provide safe dividend income but could also deliver substantial capital gains if they are bought out.

Speak Your Mind

You must be logged in to post a comment.