The biggest banking failure of 2013 occurred today in Texas as regulators closed the First National Bank, Edinburg, Texas, The failed bank becomes the 22nd banking failure of the year and the first in Texas. First National Bank, with $3.1 billion in total assets, is the largest bank failure since May 14, 2010 when Midwest […]

Uninsured Depositors Face Losses on The Failure of The Community’s Bank, Bridgeport, CT

For the first time in over a decade a Connecticut bank failed as regulators swooped in to close The Community’s Bank, with headquarters in Bridgeport, CT. The Community’s Bank was a very small bank with only $26.3 million in assets that was floundering under an avalanche of nonperforming loans. Established in 2001 the Bank was […]

Number of Problem Banks Decline By 10% In Second Quarter

The latest Quarterly Banking Profile issued by the FDIC today shows almost a 10% decline in the number of banks on the confidential FDIC Problem Bank List. The number of problem banks finally declined to under 600 for the first time since the first quarter of 2009. The number of problem banks declined by 59 […]

Sunrise Bank of Arizona Closed By Regulators, Fifth Bank Collapse For Capitol Bancorp in Three Months

State regulators closed down the Sunrise Bank of Arizona, Phoenix, Arizona, and appointed the FDIC as receiver. To protect depositors, the FDIC sold the failed bank to First Fidelity Bank, N.A., Oklahoma City, Oklahoma, which will assume all deposits of Sunrise Bank. The failure of Sunrise Bank of Arizona is noteworthy since it is the […]

Community South Bank, TN, Becomes Second Largest Bank Failure of 2013

The second largest bank failure of the year occurred today as regulators closed down Community South Bank, Parsons, Tennessee, which had total assets of $386.9 million as of June 30, 2013. The largest bank closing of the year in terms of total assets occurred on June 7, 2013 when regulators shuttered Mountain National Bank, also […]

Bank of Wausau, WI, Closed by Regulators – 18th Bank Failure of 2013

Bank of Wausau, a small community bank serving central Wisconsin, was shut down by state financial regulators who appointed the FDIC as receiver. To protect depositors, the FDIC sold the failed bank to Nicolet National Bank, Green Bay, Wisconsin, which will assume all deposits. All depositors of Bank of Wausau will automatically become depositors of […]

Feds Close First Community Bank of Southwest Florida – 17th Bank Failure of 2013

After a hiatus of almost two months bank failures resumed with a Florida bank becoming the 17 bank failure of the year. Regulators got back to work and closed the First Community Bank of Southwest Florida, Fort Meyers, FL, also operating as Community Bank of Cape Coral, Cape Coral, FL. The holding company for the […]

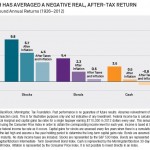

Bank Depositors Take More Risk Than They Realize

Bank depositors have long enjoyed the comfort of knowing that their savings are insured by the FDIC and, if necessary, by a $500 billion line of credit from the U.S. Treasury that is available to address systemic risks and unforeseen losses in the banking industry. In times of economic distress, the deposit insurance program has […]

Mountain National Bank, Tennessee, Closed By Regulators – 16th Bank Failure of 2013

Mountain National Bank, Sevierville, TN was closed today by the Office of the Comptroller of the Currency. The FDIC, appointed as receiver, sold the failed bank to First Tennessee Bank, N.A., Memphis, TN, which will assume all deposits of Mountain National Bank. Originally founded in 1998, Mountain National Bank becomes the first bank failure of […]

1st Commerce Bank, Nevada, Closed By Regulators – Fourth Bank Collapse In A Month for Capitol Bancorp

Nevada had its first bank failure in over two years as regulators swooped in to close tiny 1st Commerce Bank, North Las Vegas, Nevada. After closing the bank, the FDIC exercised its powers as receiver and sold the failed bank to Plaza Bank, Irvine, CA. All customer of 1st Commerce will automatically become customers of […]