Bank depositors have long enjoyed the comfort of knowing that their savings are insured by the FDIC and, if necessary, by a $500 billion line of credit from the U.S. Treasury that is available to address systemic risks and unforeseen losses in the banking industry.

In times of economic distress, the deposit insurance program has prevented bank runs which could potentially cripple the entire U.S. economy. During the financial crisis of 2008, depositors were comforted by protecting their savings from loss while the stock market tanked by 50%. Banks took on the role of a safe haven for the savings of middle class Americans.

As of March 31, 2013, banks held total FDIC insured deposits of $6.0 trillion. While bank depositors may sleep well during turbulent financial times, holding cash in the bank can be very costly from a lost opportunity standpoint. Due to the Federal Reserve’s zero interest rate policy, most bank deposits earn virtually nothing today. Some people understand this and accept the low returns as the cost of maintaining a stable level of savings, a tactic that is understandable considering the risk and volatility of stocks, bonds and other types of investments.

Sound financial planning dictates maintaining enough readily available cash to meet unexpected bills and emergencies. Maintaining a very high level of savings in cash, however, exposes depositors to the significant risk of a loss in purchasing power after accounting for inflation and taxes.

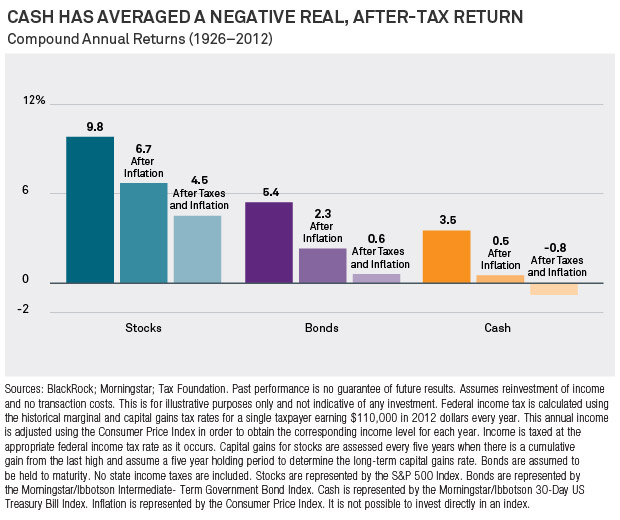

Safety and comfort come at a price as noted in an analysis done by the financial professionals at BlackRock. An over-allocation to cash can result in not meeting your financial goals due to inflation eroding the purchasing power of cash. According to BlackRock, cash is the only asset class that has actually lost money over the long run compared to stocks and bonds as shown below.

Although circumstances vary for each individual, holding cash is not the way to increase net worth over the long term.

Speak Your Mind

You must be logged in to post a comment.