How does the average consumer get by without a basic checking account? How does someone without a checking account pay the bills that arrive each month – drive around to each creditor and pay in cash? Where do you keep your savings – under the mattress or buried in the back yard? As incredible as […]

Banks Tell 30 Million Troubled Customers To Get Lost – One In Three Consumers Now “Unbanked”

Interest Rates At All Time Lows And Home Prices At Ten Year Lows – Why Are Home Sales The Worst Ever?

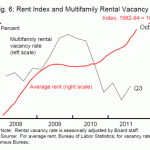

In Federal Reserve Chairman Ben Bernanke’s world, all he had to do was lower interest rates enough and housing prices would magically re-inflate. Wrong! Mortgage rates are at all time lows, home prices are at 2002 levels and owning a home is just as cheap as renting, yet the housing market remains mired in a […]

Too Big To Fail Banks Get Bigger – Fundamental Financial Problems Worse Than 2008

David Stockman, former budget director in the Reagan administration, argues persuasively that the fundamental problems of the financial system are worse than in 2008. The “too big to fail” banks have become bigger, politicians have been bought and paid for, an entitled class of Wall Street financiers are being served by government policies and a […]

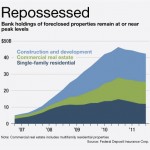

Widespread Banking Failures Predicted As Housing Values Continue To Plummet

According to Micheal Olenick, founder of FindtheFraud, the worst of the housing crash and banking crisis still lies ahead of us. Mr. Olenick’s excellent in depth analysis discusses the multiple factors that are prolonging the foreclosure crisis and explains how banks and servicers are trying to delay taking losses that could eventually reach a staggering […]

Everyone and No One Is In Charge Of Fixing The Housing Crisis

The housing crisis is widely viewed as the biggest impediment to economic recovery. Despite the expenditure of trillions of dollars in financial support from the Federal Reserve and other government agencies, housing prices continue to decline. In addition, the wide ranging regulatory overhaul of banking and mortgage practices being implemented under the Dodd-Frank Act, is […]

Major Mortgage Lender Calls It Quits – Mortgages Become A Losing Proposition For Banks

While the Federal Reserve and other government agencies urge banks to lower credit standards and increase lending, one major mortgage lender is calling it quits due to onerous regulatory burdens that increase lending risks and reduce profits. MetLife, the country’s largest insurance company, is closing its $20 billion mortgage operations and firing 4,300 employees. The […]

Banking News – Daily Banking Update

Welcome to Banking Update, a roundup of articles and news from around the Internet. Banks continue to be sued for selling defective mortgages, the Fed says a housing recovery is essential for economic recovery, Americans still believe owning a home is part of the “American dream”, banks are still engaged in risky behavior, savings rates […]

FDIC Issues 72 Enforcement Actions Against Problem Banks In November

The FDIC issued a total of 72 enforcement actions against banks in November 2011, down slightly from 75 in October. Included in the November enforcement actions were 9 civil money penalties, 1 prompt corrective action and 13 consent orders. The FDIC also terminated 37 consent orders and prompt corrective action directives due to either the […]

Banking Update – Daily Banking News

Welcome to Banking Update, a roundup of articles and news from around the Internet. The Bank of America situation just keeps getting worse with another large fine for BofA, foreclosures are weighing down the balance sheets of banks, Nevada home prices just keep on dropping after a 63% delcine, home equity borrowings have collapsed, the […]