Welcome to Banking Update, a roundup of articles and news from around the Internet. The Bank of America situation just keeps getting worse with another large fine for BofA, foreclosures are weighing down the balance sheets of banks, Nevada home prices just keep on dropping after a 63% delcine, home equity borrowings have collapsed, the ECB tries to save Europe’s banks with unlimited loans and there are another 10 million home foreclosures looming in the next six years. Let’s go right to the links.

Is it possible – a bank with an easy to navigate website, actual people answering your phone calls and no fees? One bank tries a new approach.

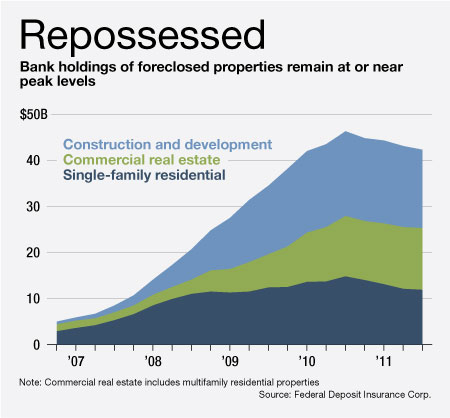

A new wave of foreclosures may drown the banking industry as delayed foreclosure actions get underway. The new wave of foreclosures begins as many banks are already drowning in foreclosed real estate.

Borrowing by homeowners against home equity has collapsed according to Calculated Risk.

Home prices in Nevada have dropped by a shocking 63% since 2006, luring out of state investors to buy properties. Nonetheless, Nevada property prices continue to drop with a year over year decline of 8%.

Regulators struggle to implement complex rules on new capital and liquidity requirements for banks under proposals by the Basel Committee on Banking Supervision.

The European Central Bank (ECB) offers “unlimited” low interest rate 3 year loans to European banks tottering on the brink of collapse. The ECB revealed today that 523 desperate banks lined up for credit, borrowing a massive $640 billion to keep their doors open. European governments, unable to borrow at market rates in the bond markets, are expecting that the banks will purchase their debt with the newly created money provided by the ECB. Keep in mind that many banks were essentially rendered insolvent due to the large amount of government debt they already held which had collapsed in value due to worries about defaulting govenments and soaring interest rates.

The amount of homes in “shadow inventory” threaten to overwhelm the housing industry. There are 3.2 million residential mortgage loans that are delinquent by 12 months or more which need to be foreclosed by banks and sold. Considering additional future defaults by delinquent and underwater borrowers, the EconoMonitor expects that a staggering 10.4 million homes “are at risk of default over the next 6 years.”

Is stupidity a proper defense for a subprime borrower? Bank of America takes another third of a billion dollar hit for alleged discrimination against minority borrowers who, according to the Justice Department had “no idea” of what they were doing when they accepted the money lent to them.

That’s it for today – have a great evening!

Speak Your Mind

You must be logged in to post a comment.