Fannie Mae and Freddie Mac just keep on laughing at the taxpayers as they award bonuses, send employees off on expensive travel junkets and pile up losses that have already cost the taxpayers $183 billion. Just weeks after it was revealed that the top ten executives at Fannie and Freddie received $47.8 million in bonuses […]

Fannie and Freddie Send Employees To Lavish Conference At Cost of $640,000 – Laughing At The Taxpayers While Losing Billions

New FDIC Vice Chairman May Seek To Break Up Big Banks

Will the “too big to fail” banks that pose a systemic risk to the financial system ever be broken up? If Thomas Hoenig, former Kansas City Fed president wins Senate nomination as the new Vice Chairman of the FDIC, the big banks may have a lot to worry about. Mr. Hoenig should easily win Senate […]

Why Are We Having Nonstop Financial Crises?

Issuing a sell opinion on a bank stock is usually a short route to oblivion for a banking analyst. Mike Mayo is one banking analyst who did issue sell opinions on banks yet managed to survive. In his new book, “Exile on Wall Street”, banking analyst Mike Mayo provides an insider’s view on why the […]

Bank Of America Derivatives Timebomb Shows System Is Corrupt To The Core

The Federal Reserve recently allowed Bank of America to move its massive derivative positions from the bank holding company to its banking subsidiary which is an FDIC insured depository institution. By allowing this transfer, the Federal Reserve has allowed Bank of America to shift the risk of loss on speculative derivative contracts from the non-bank […]

FHFA Head Says Fannie Mae and Freddie Mac Cannot Be Fixed

In a speech before the American Mortgage Conference, Acting Director Edward DeMarco of the Federal Housing Finance Agency (FHFA), said that Fannie Mae and Freddie Mac have little chance of emerging from conservatorship. Both Fannie Mae and Freddie Mac, the mortgage financing giants of the housing industry, faced collapse in late 2008 as mortgage defaults […]

Fed Puts Bank Dividend Payments On Hold Until Capital Adequacy Tested

November 17, 2010 – As anticipated, the Federal Reserve Board issued guidelines to the nation’s largest bank holding companies (BHCs) for evaluating plans to pay stock dividends or repurchase common stock. The Fed stated that the guidelines are a conservative approach to “ensure that the BHCs hold adequate capital to maintain ready access to funding, […]

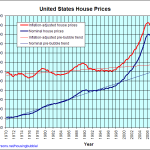

IMF – Risks To Real Estate And Banking Sector Remain Elevated

October 6, 2010 – The International Monetary Fund warned of elevated risks to global economies, real estate and the banking sector in its latest World Economic and Financial Survey. The IMF’s pessimistic outlook for economic recovery zeroed in on the risks associated with excessive levels of sovereign, commercial and household debt in an environment of […]

Monterey County Bank, Monterey California, Cited By FDIC For Deceptive Practices

October 5, 2010 – Monterey County Bank, Monterey, California, agreed to pay $3 million under a Consent Order with the FDIC for deceptive practices under the Fair Debt Collection Practices Act. The terms of the settlement were announced in an FDIC Press Release. The Federal Deposit Insurance Corporation (FDIC) announced a settlement with Monterey County […]

FDIC Says Dodd-Frank Act Ends “Too Big To Fail” Era

September 3, 2010 – FDIC Chairman Sheila Bair, in testimony before the Financial Crisis Inquiry Commission discussed how future systemic risks can be better managed and reduced under provisions of the Dodd-Frank Act. Chairman Bair also said that new liquidation authority under the Act is a fundamental factor that will allow the U.S. to end […]

Should Banks Be Allowed To Resume Subprime Lending?

As discussed in a previous post, based on the total number of Americans with a credit score of 649 or lower, up to 35% of all Americans are effectively locked out of the refinance or purchase mortgage market for the foreseeable future (see One Third of All Americans Unqualified). In the past, borrowers who did […]