November 17, 2010 – As anticipated, the Federal Reserve Board issued guidelines to the nation’s largest bank holding companies (BHCs) for evaluating plans to pay stock dividends or repurchase common stock. The Fed stated that the guidelines are a conservative approach to “ensure that the BHCs hold adequate capital to maintain ready access to funding, continue operations, and continue to serve as credit intermediaries, even under adverse conditions”.

According to the Fed, the new guidelines for evaluating capital distributions will be based on a number of criteria, with particular emphasis on:

1- the firm’s ability to absorb losses over the next two years under several scenarios, including an adverse macroeconomic scenario specified by the Federal Reserve and adverse scenarios appropriate for a particular firm’s business model and portfolios;

2. how the firm will meet Basel III capital requirements as they take effect in the United States, in the context of the proposed capital distributions as well as any anticipated impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act on the firm’s business model or capital adequacy; and

3. the firm’s plans to repay U.S. government investments, if applicable. BHCs are expected to complete the repayment or replacement of any U.S. government investments in the form of either preferred shares or common equity prior to increasing capital payouts through higher dividends or stock buybacks.

In order for the Fed to evaluate a bank’s request to pay dividends or repurchase stock, the nation’s largest banks will be required to submit comprehensive capital plans by early 2011. All large banks are required to submit a capital plan regardless of capital distribution plans.

Banks have been subjected to increased regulatory scrutiny since the financial crisis. Regulators were criticized for allowing excessive risk taking and inadequate capital levels which brought the banking industry to the brink of collapse in 2008.

The Fed noted the success of the Capital Assessment Program (commonly referred to as the “stress tests”) of 2009 which provided regulators with information to accurately assess the soundness of the nation’s largest banks. The Federal Reserve noted that they plan to undertake reviews of capital adequacy on a regular basis going forward.

The Fed said it plans on responding to dividend payment requests in the first quarter of next year. The results of the Fed’s analysis of the capital adequacy of the large BHCs will not be made public.

Some of the nation’s largest banks, including Wells Fargo, J.P.Morgan Chase and U.S. Bancorp, have already indicated that they plan on paying dividends, subject to Fed approval.

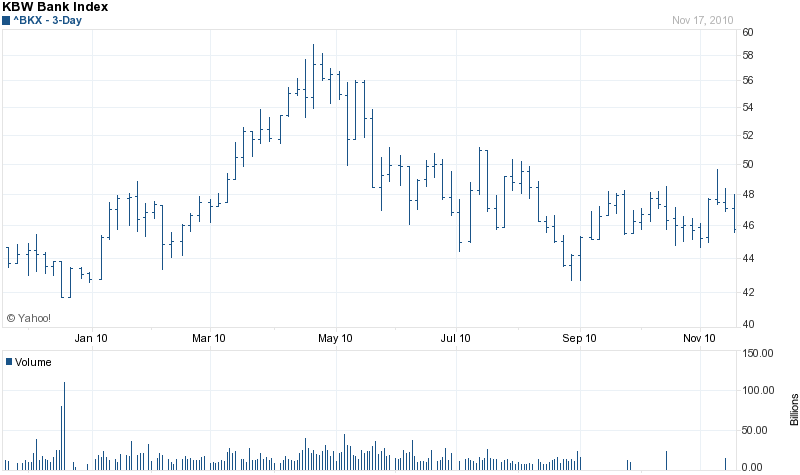

As can be seen by the price action of the KBW Bank Index, bank stocks have dramatically lagged the overall market this year. Investors are still trying to assess a host of issues that could negatively affect bank earnings such as increased regulatory oversight and large buyback requests on defaulted mortgages. Instituting or increasing dividend payments would be one way of attracting additional investors to the banking stocks and increasing share values.

Speak Your Mind

You must be logged in to post a comment.