In a speech before the American Mortgage Conference, Acting Director Edward DeMarco of the Federal Housing Finance Agency (FHFA), said that Fannie Mae and Freddie Mac have little chance of emerging from conservatorship.

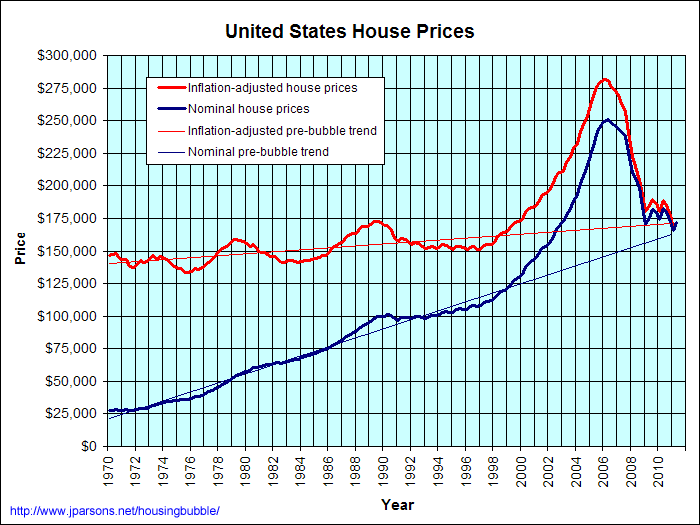

Both Fannie Mae and Freddie Mac, the mortgage financing giants of the housing industry, faced collapse in late 2008 as mortgage defaults skyrocketed and property values collapsed. On September 7, 2008, the FHFA placed both of the government sponsored entities (GSE) into conservatorship to ensure their solvency and prevent a complete collapse of the mortgage markets.

The U.S. Treasury later committed itself to unlimited funding to both Fannie and Freddie to ensure their continued operation. To date, the U.S. Treasury has given Fannie Mae $104 billion and Freddie Mac $65 billion of taxpayer money to keep them in operation.

FHFA DeMarco said that he knew in advance that reforming Fannie and Freddie would be difficult, but the “general expectation was that more progress would have been made by now. According to DeMarco, future prospects for the GSEs are bleak.

It ought to be clear to everyone at this point, given the Enterprises’ losses since being placed into conservatorship and the terms of the Treasury’s financial support agreements, that the Enterprises will not be able to earn their way back to a condition that allows them to emerge from conservatorship. In any event, the model on which they were built is broken beyond repair. Conservatorship allows the Enterprises to continue serving their public purpose while lawmakers determine the ultimate resolution of the conservatorships and the future legal structure for housing finance.

Yet, after three years, there still is no clear direction as to what legal and institutional structures will replace the Enterprises and their central position in the housing finance market. This puts FHFA in a difficult position as it provides direction to the Enterprises’ ongoing activities and future business strategies.

DeMarco also said that the GSEs must shrink their market presence and reduce their retained portfolio to mitigate future risk. In addition, the GSEs currently insure mortgages at below market rate premiums which adds another layer of future risk to the GSEs, especially when considering the weak state of the housing market.

Placing Fannie and Freddie in conservatorship was never viewed as a long term solution, according to DeMarco. Although there have been discussions, Congress has never developed a plan to restructure housing finance and until they do, Fannie and Freddie will remain in conservatorship indefinitely.

DeMarco has every right to be bleak about the future prospects of Fannie and Freddie. Politicians in Washington have become totally dysfunctional during the worse financial crisis the country has ever faced. Meanwhile, the taxpayers can look forward to funding unlimited losses to keep the two bankrupt agencies alive.

Speak Your Mind

You must be logged in to post a comment.