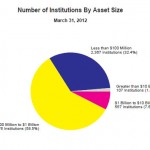

The latest FDIC Quarterly Banking Profile highlights the sharp decline in the number of banks over the past 24 years. For the quarter ending September 30, 2014 the number of FDIC insured institutions totaled 6,589 down by 56 percent from a total of 15,158 in 1990. Since December 1998 the number of banks has dropped […]

Over 8,500 Banks Have Disappeared Since 1990 – “Too Big to Fail” Remains a Banking Reality

Would Bank Living Wills/Resolution Plans Actually Help Resolve the Next Banking Crisis?

The public portions of the annual resolution plans or living wills of 17 large financial institutions were jointly released by the FDIC and the Federal Reserve Board today. The resolution plans describe in detail a financial institution’s plans for a rapid and orderly resolution under the U.S. Bankruptcy Code to address material financial distress or […]

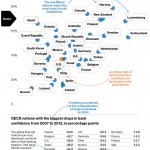

Most Americans Still Don’t Trust Banks and Here’s Why

Six years after the near melt down of the United States banking industry in 2008, more than half of all Americans still lack confidence in both the banking system and the government. Interestingly the United States with some of the biggest banking institutions in the world and the implicit backing of the United States Treasury […]

Two U.S. Banks Included In “The World’s 20 Strongest Banks”

A short number of years ago the “too big to fail banks” had to be bailed out with trillions of dollars in financial aid from both the taxpayers and the Federal Reserve. At one point there were serious discussions about nationalizing the entire U.S. banking industry. As a sign of how rapidly America’s largest banks […]

Fed Says Largest Banks Would Lose Half Trillion Dollars Under Adverse Economic Conditions

Based on the results of the Federal Reserve’s stress tests, the nation’s 18 largest banks would collectively lose a massive $462 billion under an extremely adverse hypothetical economic scenario. Reflecting the severity of the stress scenario–which includes a peak unemployment rate of 12.1 percent, a drop in equity prices of more than 50 percent, a […]

Bank “Stress Tests” Results Due In March – Don’t Expect Anyone To Fail

Under the Dodd-Frank Act, the Federal Reserve is required to conduct stress tests which are forward-looking exercises to determine whether large institutions have sufficient capital to absorb large losses and support operations under severely adverse economic conditions. The supervisory stress tests include examining capital ratios, revenue and the size of potential losses. The Federal Reserve […]

The Rally In Big Bank Stocks May Be Over

For over the past year, the stocks of big banks have rallied significantly. Lower loan losses, a stabilization of the real estate market and a settlement with the government over shortcomings in foreclosure proceedings have all contributed to a growing conviction by investors that the worst is over for the banking industry. Here’s a look […]

Why Banks Will Continue To Blow Up

Although there were a multitude of factors involved in the banking collapse of 2008, many analysts believe that the repeal of Glass-Steagall was one of the major triggers. No less an authority than Sandy Weill, former Citigroup CEO, joined the chorus of voices last week in calling for the reinstatement of the Glass-Steagall Act. Would […]

Banks Are A Financial Disaster For Both Shareholders And Depositors

In days gone by, shareholders of large banks viewed their investments as a source of income via dividends and potential capital gains via share appreciation. In days gone by, depositors viewed banks as the safest place to harbor their hard earned dollars while earning a respectable amount of interest income. That was then, this is […]