In 2007 it would have been inconceivable for anyone to imagine that savers would receive virtually zero percent return on their money. The entire concept of wealth creation is built not only upon savings but upon the magic of compound interest whereby your money works for you by earning more money. It wasn’t that long […]

Yes – It Is Still Possible to Get High Interest Rates on Your Savings

Home Equity Loans – Why Banks and Borrowers Both Love Them

With interest rates at all time lows why wouldn’t banks love handing out home equity lines of credit (HELOC)? Since HELOCs are all written as adjustable rate second mortgages any increase in interest rates translates into instantly higher profits for banks. With a HELOC the borrower takes on interest rate risk as opposed to a […]

Whatever Happened to Money Market Fund Rates? The New World of Zero Return and High Risk

Here’s an interesting tidbit from Merrill Lynch on the various money market funds that investors can sweep excess cash into. The yields are enough to bring retired investors trying to live off of yield to tears. It’s hard to believe looking back that a mere five years ago, prior to the financial meltdown, savers could […]

Housing Recovery Stalls as Old Rules for Recover No Longer Apply

The old rules for a strong housing market appear to have changed in a fundamental manner frustrating traditional analysts who have been predicting a housing recovery. In the latest Economic and Housing Market Outlook report, Freddie Mac examines three fundamental areas in the housing market that have not behaved as expected which has contributed to […]

Bernanke Tells Retirees and Savers “To Take One For The Team” – Interest Rates To Remain At Zero

Federal Reserve Chairman Ben Bernanke presented to Congress today the semiannual Monetary Policy Report which discusses current economic conditions, monetary policy and thoughts on fiscal policy. Mr. Bernanke vigorously defended the Federal Reserve’s zero interest rate policy stating that the benefits of an easy money policy outweigh the “potential costs of the increased risk-taking in […]

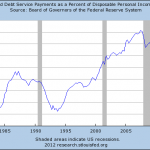

Staggering Debts Have Wrecked Our Economic Future

Bold actions by the Federal Reserve to smash interest rates to historically low levels were undertaken to reduce the burden of debt payments on consumers and businesses. The dramatic drop in interest rates since 2008, as well as a more cautious attitude towards debt by consumers, has resulted in lowering the household debt service ratio […]

Negative Real Interest Rates – The Invisible $290 Billion Tax On Savers

Whatever happened to the concept of earning interest on savings? Since the start of the financial crisis in 2008, the Federal Reserve has aggressively suppressed interest rates to near zero. The Fed’s rationale for lowering interest rates was to get the economy back on track by lowering borrowing costs for both consumers and businesses. Lower […]

Bank Savers Get Zero Returns – Is It Time To Invest In Bond Funds?

Many former bank savers, disgusted by the near zero rates offered on their savings by banks, have increasingly turned to bond funds as a means of harvesting interest income. Since 2008, when the Federal Reserve decided to force interest rates to unprecedented lows, investors have poured a staggering $1 trillion into bond funds. Will 2013 […]

Fed Guarantees Bank Savers Negative Returns

Anyone with savings in the bank is painfully aware of the fact that they are receiving only slightly more income than someone who keeps their savings under the mattress. In an attempt to stimulate credit demand by lowering interest rates to near zero, the Federal Reserve has effectively guaranteed negative returns to savers after taking […]

Mortgage Borrowers Pay Thousands In Excess Fees Due To Complex Bank Pricing

Few people wonder if they got the best price on that newly purchased 65” HDTV. Transparency in retail pricing through technological advances has enabled consumers to quickly locate the retailer selling a product at the lowest cost. A few quick clicks on the web or the use of price comparisons apps such as Amazon’s “Price […]