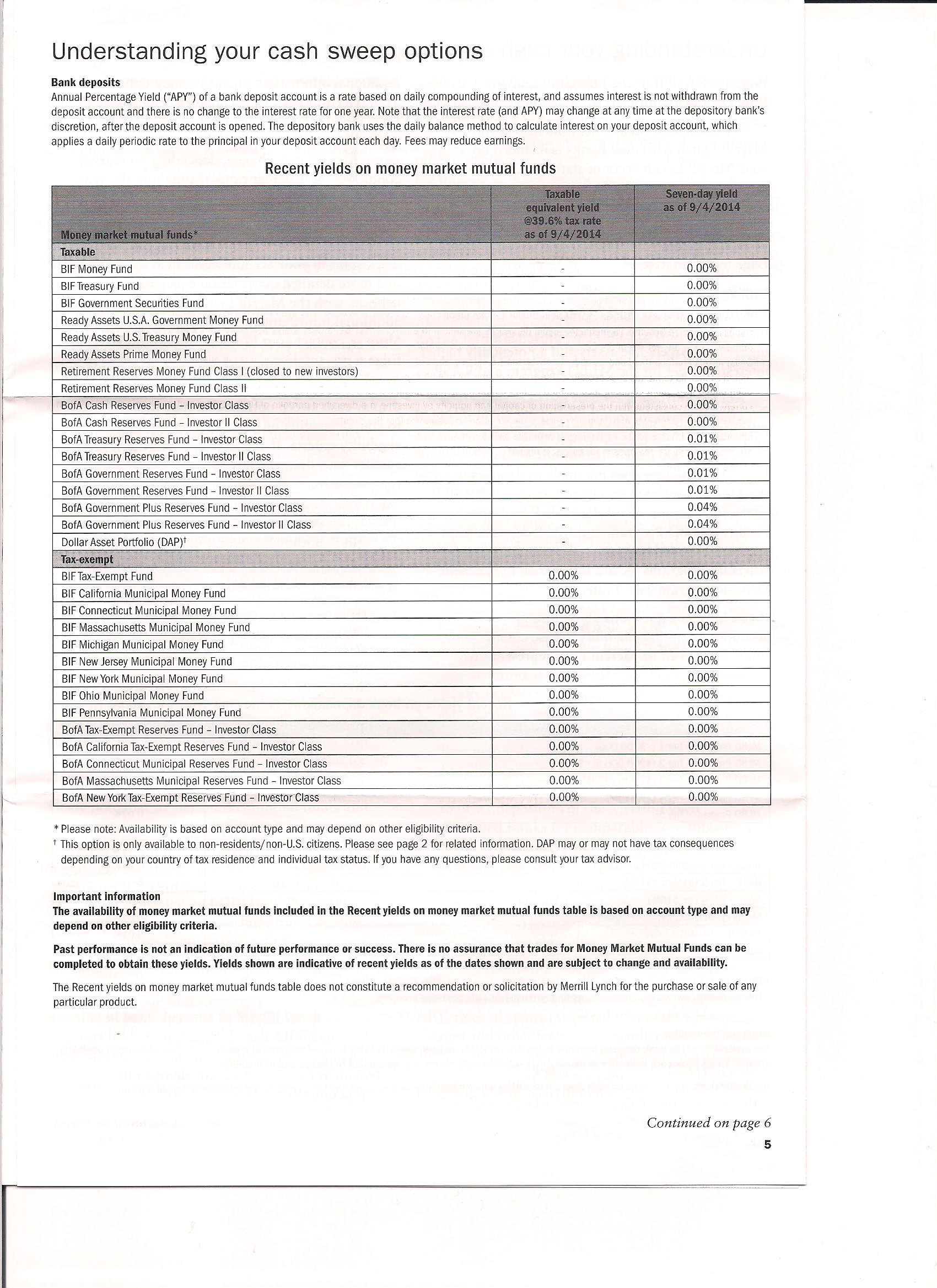

Here’s an interesting tidbit from Merrill Lynch on the various money market funds that investors can sweep excess cash into. The yields are enough to bring retired investors trying to live off of yield to tears.

It’s hard to believe looking back that a mere five years ago, prior to the financial meltdown, savers could have reaped a 5% yield with no risk. Despite the recent curtailment of quantitative easing by the Federal Reserve, slow growth and low inflation in the U.S. along with a European economy teetering on recession will probably prevent the Fed from even thinking about raising interest rates for the foreseeable future.

Courtesy: WSJ.com

So exactly what options do savers have today? A large percentage of people do not trust the stock market after the crash of 2008-2009 that sunk portfolio values by around 50%. Banks, which barely pay more on savings accounts and certificates of deposits than money market fund yields, are bulging with cash. Despite near zero returns, deposits at banks have increased tremendously to a staggering total of $10.4 trillion on which the after tax, after inflation yield is negative. Not exactly an attractive option for anyone with idle cash – and if not for FDIC insurance, putting money into a bank would be the equivalent of putting your money under the mattress.

Savers seeking yield today are forced to put their money into bond funds with very long maturities. For example, the iShares 20 Year Treasury Bond (TLT) sounds great since it invests in U.S. government debt and yields almost 3%.

Many investors desperate for yield are dumping huge amounts into long term maturity bond funds since that is the only way to get any kind of a yield today but there is no such thing as a free lunch or in this case a riskless return. The really big risk with long term bonds funds revolves around the fact that if interest rates ever do go up, the principal value of a bond fund with long dated maturities will decline significantly.

A drop in the value of a bond fund that is caused by a rise in interest rates is measured by what is called duration, a term many bond fund investors have never heard and probably wouldn’t understand. The duration of a bond fund lets an investor know how much the value of his investment in a bond fund will change based on a 1% increase in interest rates. For example, a bond fund with a duration of 5 years will decline in value by 5% if interest rates rise by only 1%. The higher the duration, the more sensitive a bond fund will be to a change in interest rates. (See also Fixed Income Investors Face Many Risks).

In the case of the iShares 20 Year Bond Fund (TLT) cited above, investors accepting a mere 3% yield are taking enormous risk since the duration of the TLT is 16.7. An investor with $100,000 in the TLT would see the value of his holdings drop by $16,700 to $83,300 if interest rates rise by only 1%. Under this scenario it would take an investor in the TLT over 5.5 years to recover his loss from the 3% interest yield on the original principal investment. If interest rates jumped by 3%, the loss to an investor in the TLT would be catastrophic.

The Federal Reserve’s zero interest rate policy has given borrowers lower rates but has condemned savers to a world of zero returns or ultra high risk.

Speak Your Mind

You must be logged in to post a comment.