Few people wonder if they got the best price on that newly purchased 65” HDTV. Transparency in retail pricing through technological advances has enabled consumers to quickly locate the retailer selling a product at the lowest cost. A few quick clicks on the web or the use of price comparisons apps such as Amazon’s “Price Check” or “Red Laser” allow a shopper to quickly compare selling prices between different retailers. The easy ability to price compare before buying has resulted in huge savings for consumers.

Few people wonder if they got the best price on that newly purchased 65” HDTV. Transparency in retail pricing through technological advances has enabled consumers to quickly locate the retailer selling a product at the lowest cost. A few quick clicks on the web or the use of price comparisons apps such as Amazon’s “Price Check” or “Red Laser” allow a shopper to quickly compare selling prices between different retailers. The easy ability to price compare before buying has resulted in huge savings for consumers.

Shopping for a mortgage, however, is an entirely different story. The complex mortgage application process and opaque pricing policies are extremely confusing to most consumers. The mortgage industry seems to pride itself on offering a bewildering variety of pricing options and fees that make it both time consuming and almost impossible to determine which lender is actually offering the best deal. Most consumers have neither the time, inclination or ability to match wits with the mortgage pros and, accordingly, wind up paying higher rates and fees.

According to a recently completed Fannie Mae survey, many mortgage borrowers do not properly investigate or fail to understand the mortgage choices available to them. This results in paying thousands of dollars more than necessary and expands the probability of problems arising during the life of the loan.

“Homeowners who don’t obtain multiple mortgage offers or compare rates are essentially leaving money on the table, particularly given today’s unprecedentedly low interest rates,” said Fannie Mae Chief Economist Doug Duncan. “Although a home purchase is the largest financial obligation most people will ever make, many borrowers do not fully understand their mortgage products and costs. As a result, some homeowners in this position may find themselves with unsustainable payments down the road.”

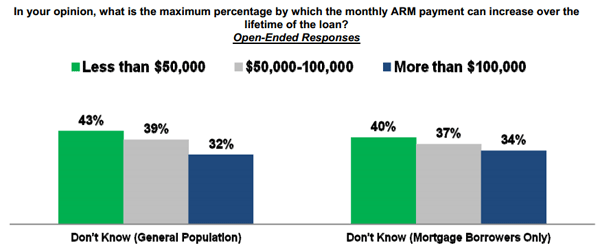

The mortgage industry is also doing a poor job of explaining mortgage terms to borrowers who apply for adjustable rate mortgage (ARM). The Fannie Mae survey notes that up to 40% of borrowers taking out adjustable rate mortgages have no idea how much the mortgage payments might increase in future years.

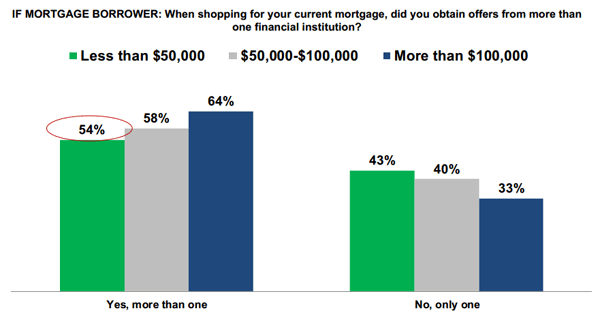

Making matters even worse, those who can least afford to overpay do the least amount of shopping for the best mortgage. The Fannie Mae study notes that lower income groups were the most likely to obtain a quote from only one lender. The survey does not draw conclusions about the correlation of education and intelligence to income levels.

Despite the so called reforms that were enacted in the wake of the mortgage crisis, getting a mortgage remains a lot like buying a car – quotes vary tremendously and there are many mortgage companies who charge numerous “junk fees” which can add thousands of dollars to the cost of obtaining a mortgage. Fannie Mae Research indicates that “borrowers who obtain multiple mortgage broker quotes can save $1,000 or more in closing costs.” The Federal Reserve puts the figure even higher, noting that “shopping, comparing, and negotiating may save borrowers thousands of dollars.”

Many consumers may wonder why the price of a mortgage varies tremendously based on which lender they go. This is a very valid question since most mortgages wind up being bought by federal agencies and the funding costs of banks are relatively similar. Even more galling, the Consumer Financial Protection Bureau (CFPB) which has dictatorial powers, a budget of over half a billion dollars and primary responsibility for regulating consumer protection with regards to financial products, has effectively done nothing to ensure that consumers are not being taken advantage of by unscrupulous mortgage lenders.

Many Americans may also wonder why the cost of the exact same product, such as the 30 year fixed rate mortgage, can vary by thousands of dollars among different lenders. Since almost all the mortgage money effectively comes from the government, why not regulate the mortgage industry like a public utility to ensure equal and fair pricing for all consumers? Does your neighbor pay more per kilowatt hour for electricity than you do? Of course not, and the same transparency in pricing for regulated electric companies should exist in the mortgage industry.

A quick internet search of bank sites shows how dramatically closing costs and rates can vary for the exact same 30 year fixed rate mortgage. Keep in mind that the 30 year fixed rate mortgage is the industry’s standard product and there is little added value that any one particular mortgage lender provides to a borrower, despite the large differences in closing costs and interest rates.

Rate quotes listed below are for a 30 year fixed rate, $200,000 mortgage refinance. The annual percentage rate (APR) shows the true annual cost of a loan including closing costs. The higher the APR, the higher the closing costs charged by a lender.

Bank Rate Points APR

Bank of America 3.500% 1.125 3.652%

People’s United Bank 3.000% 1.250 3.239%

Quicken Loans 3.625% 1.000 3.785%

Compounding the confusion for many consumers is the fact that the rates for each lender will vary depending on the number of points a consumer chooses to pay. One point is equal to 1% of the loan amount which would be $2,000 on a $200,000 mortgage. Trying to determine if it makes sense to pay expensive points on a mortgage opens a whole new Pandora’s box of confusion as borrowers try to decipher the difference in costs based on the expected life of the loan, tax savings and changes in the monthly payment. The task of selecting the best mortgage is usually beyond the ability of even the most sophisticated consumers due to the complex overlays of fees, points and interest rates.

Don’t expect mortgage lenders to become more transparent in pricing or to provide equal treatment to all consumers. Despite the establishment of large bureaucratic agencies such as the Consumer Financial Protection Board and a new onslaught of regulation under the “Dodd-Frankenstein Act”, consumers continue to pay more than should on mortgages and are unable to understand the product. The Fannie Mae study on mortgage borrowing concludes with this depressing conclusion:

Research done by Federal Trade Commission economists finds that the majority of mortgage borrowers are confused about key elements of their loan terms and costs. Some of these borrowers spent considerable time comparison shopping. Others relied on their loan officer or mortgage broker to explain the loan terms, or on the lender’s reputation or recommendation of a friend or relative, rather than their own evaluation of loan terms.

When even the smartest consumers can’t figure out if they are getting a good deal on a mortgage, you know for sure that the system is either very corrupt or very broken.

Speak Your Mind

You must be logged in to post a comment.