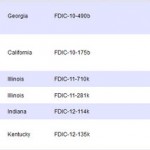

The FDIC announced today a total of 53 enforcement actions for May 2012. In the previous month, the FDIC had issued 56 enforcements actions. Enforcements actions issued in May included 9 consent orders, 10 civil money penalties, 8 section 19 orders, 13 orders terminating previous consent and cease and desist orders, 2 orders terminating prompt […]

Three Banks Fail In Tennessee, Georgia and Florida – Total 2012 Bank Failures At 31

Regulators closed three banks in three different states, as loan losses continue to plague the banking industry. Efforts by small banks to raise additional capital have become increasing difficult due to low loan demand, a slowing economy and investor antipathy towards banking stocks. The latest three banking failures in Tennessee, Georgia and Florida bring total […]

Putnam State Bank, Palatka, FL, Closed By Regulators

Putnam State Bank, Palatka, FL, established in December 1988, was closed today by the Florida Office of Financial Regulation. The FDIC, appointed as receiver for the failed bank, was able to sell Putnam State Bank to Harbor Community Bank, Indiantown, FL. During the height of the real estate mania and lending boom, few states saw […]

Four Banks Collapse In Four States – 2012 Bank Failures Total 28

After only two bank failures during May, regulators got off to a fast start in June, closing four banks in four different states. With the financial system in a period of temporary calm, the number of bank closings during 2012 has tapered off from last year’s levels. While regulators have closed 28 banks thus far […]

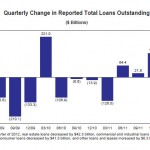

Higher Bank Profits Driven By Lower Loan Loss Provisions – Core Lending Business Declines

The earnings “recovery” in the banking industry continues to be driven by reduced loan loss provisions and higher fees rather than a fundamental improvement in the core lending business. The FDIC’s Quarterly Banking Profile for the first quarter of 2012 reports that aggregate quarterly profits of commercial banks and savings institutions increased for the 11th […]

Bank of the Eastern Shore, Cambridge, MD, Fails – Uninsured Depositors Out Of Luck As FDIC Fails To Find Buyer

Maryland state regulators closed the Bank of the Eastern Shore, Cambridge, MD and the FDIC was appointed as receiver. As has happened on previous occasions, the FDIC was unable to find a buyer for the failed bank, leaving uninsured depositors at risk of loss on their savings. To protect insured depositors and wind down the […]

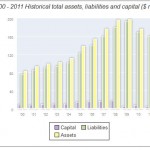

Banking Industry Slowly Recovers – 813 Banks Remain On “Problem Bank List”

The FDIC’s Quarterly Banking Profile for the fourth quarter of 2011 shows a modest but steady recovery in the banking industry. Despite the fact that a majority of banks reported improved quarterly earnings, 813 institutions remain on the Problem Bank List, comprising 11% of all FDIC insured banks and savings associations. Highlights of the 2011 […]