The goal of the Volcker Rule, which became law under the Dodd-Frank Act was to restrict speculative trading activity in risky derivatives by the Too Big To Fail Banks. The ban on proprietary bank trading was proposed by former Federal Reserve Chairman Paul Volcker who believed that one of the primary causes of the 2008 […]

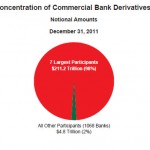

Banks Amass $211 Trillion In Derivatives, JP Morgan Loses $2 Billion And Volcher Rule Debates Continue

Dallas Fed Says “Too Big To Fail Banks” Should Be Broken Up – Future “Severe Crises” Possible

The Federal Reserve Bank of Dallas joined the growing chorus of critics who maintain that the Dodd-Frank Act will not prevent future taxpayer funded bank bailouts. The Dallas Fed said taxpayers are still at risk for the cost of large banks failures and that any future bailouts should result in severe consequences for both bank […]

HarVest Bank of Maryland Collapses – Sold To Sonabank of Virginia

The State of Maryland, which has not had a banking failure since November 2010, saw two banks collapse today as regulators closed the HarVest Bank of Maryland and the Bank of the Eastern Shore. Since the start of the banking crisis in 2008, Maryland has had a total of only 8 banking failures compared to […]

Bank of the Eastern Shore, Cambridge, MD, Fails – Uninsured Depositors Out Of Luck As FDIC Fails To Find Buyer

Maryland state regulators closed the Bank of the Eastern Shore, Cambridge, MD and the FDIC was appointed as receiver. As has happened on previous occasions, the FDIC was unable to find a buyer for the failed bank, leaving uninsured depositors at risk of loss on their savings. To protect insured depositors and wind down the […]

30,000 Whistleblowers Report Suspected Bank Fraud To Feds

The government agency established to be the watchdog over the Troubled Asset Relief Program (TARP) has been keeping busy. The financial crisis of 2008 resulted in the disbursement of over $400 billion of TARP funds which requires government oversight. In order to prevent waste, fraud and abuse of taxpayer funded TARP disbursements, Congress created the […]

Billon Dollar Bank Failure Caused By “Massive Bank Fraud” At Bank of the Commonwealth

Four years after the start of the banking crisis, federal investigators are proving what many Americans have long suspected – the root cause of many banking failures was due to fraud. The Office of the Special Inspector General for The Troubled Asset Relief Program (SIGTARP) announced last week that a massive $41 million bank fraud […]

Exponential Increase In Lending Regulations Impede Bank Lending, Provide Lifetime Employment To Government Regulators

Has the exponential increase in lending regulations since 2008 contributed to the worst economic decline since the Depression of the 1930’s? Government “solutions” to problems have a long history of failure. In addition, the unanticipated consequences of government “solutions” often result in a plethora of new problems worse than the original ones the government was […]

Bank Stress Tests Viewed As Fed Deception By Critics

Every banker knows that public confidence in the banking industry is essential. With the banking industry approaching a near meltdown last year, the Federal Reserve decided to conduct a series of “stress tests” on the country’s largest banks in order to restore confidence in the banking system. After reviewing the results of the stress tests, […]

Fed Says Banks Can Withstand Financial Hurricane – Savers, Borrowers and Shareholders Not So Lucky

Stress tests of the largest banks in the country against a financial hurricane of “extremely adverse” economic conditions shows that almost all of the largest banks in the country would be able to maintain adequate capital levels. The Federal Reserve said that 18 of the 19 banks stress tested would survive even if stock prices […]