The latest FDIC Quarterly Banking Profile highlights the sharp decline in the number of banks over the past 24 years. For the quarter ending September 30, 2014 the number of FDIC insured institutions totaled 6,589 down by 56 percent from a total of 15,158 in 1990. Since December 1998 the number of banks has dropped […]

Over 8,500 Banks Have Disappeared Since 1990 – “Too Big to Fail” Remains a Banking Reality

Would Bank Living Wills/Resolution Plans Actually Help Resolve the Next Banking Crisis?

The public portions of the annual resolution plans or living wills of 17 large financial institutions were jointly released by the FDIC and the Federal Reserve Board today. The resolution plans describe in detail a financial institution’s plans for a rapid and orderly resolution under the U.S. Bankruptcy Code to address material financial distress or […]

Two U.S. Banks Included In “The World’s 20 Strongest Banks”

A short number of years ago the “too big to fail banks” had to be bailed out with trillions of dollars in financial aid from both the taxpayers and the Federal Reserve. At one point there were serious discussions about nationalizing the entire U.S. banking industry. As a sign of how rapidly America’s largest banks […]

Ridiculous Divergence Between Bank CEO Pay And Shareholder Returns

The wide divergence between bank CEO compensation and shareholder returns is an embarrassment to the capitalist notion of linkage between performance and pay. Shareholders of banking stocks have seen the value of their investments pulverized over the past four years as the banking industry struggles to recover from the lending excesses of previous years. Shareholders […]

Bank Of America, Hated By Many, Could Make Some People Rich In 2012

During 2011, some of the smartest investment pros in the world bet heavily on Bank of America and lost big as the stock price collapsed. Concerns over the looming collapse of the European banking system sent U.S bank stocks into a tailspin as panicked investors sold. From a price of $15 in January 2011 the […]

Foreclosure Settlement Q&A – Who Wins, Who Loses – A Victory For The Irresponsible

A $25 billion foreclosure settlement reached between the government and the big banks has many wondering who will win and who will lose among the different parties involved. Although the settlement is complicated and will take years to work out, the basic framework will please some and annoy others. Here are some basic questions and […]

29 Banks That Could Destroy The Global Economy

The Financial Stability Board (FSB) was established to coordinate international efforts to promote effective regulation and supervision of the global financial system. In its latest report on global systemically important banks, the FSB makes it clear that the world’s largest banks have become too big to fail without crashing the global economy. The leaders of […]

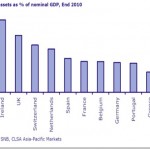

Too Big To Fail Casino Banks Make $518 Billion Bet On PIIGS Sovereign Debt

The “Too Big To Fail Banks” are at it again, making huge speculative bets on the odds of sovereign default by Portugal, Italy, Ireland, Greece and Spain. The costly lessons of the derivatives debacle of 2008 have apparently been forgotten. In 2008, the Too Big To Fail banks bought massive amounts of credit default swaps […]

FDIC To Cover Losses On $75 Trillion Bank of America Derivative Bets

Potential losses on Bank of America’s massive $75 trillion book of risky derivative contracts has just been dumped onto the FDIC by the Federal Reserve. Derivatives, once described by Warren Buffet as “financial weapons of mass destruction” are complex contracts entered into for speculation or to hedge risks linked to a wide variety of other […]