Although there were a multitude of factors involved in the banking collapse of 2008, many analysts believe that the repeal of Glass-Steagall was one of the major triggers. No less an authority than Sandy Weill, former Citigroup CEO, joined the chorus of voices last week in calling for the reinstatement of the Glass-Steagall Act. Would […]

Peregrine Financial CEO Confesses To 20 Year Undetected Fraud

Russell Wasendorf, Sr., CEO of Peregrine Financial Group (aka PFG Best) admitted in a suicide note that he had embezzled millions of dollars from customers for the past 20 years. The reason the financial fraud was able to continue undetected for so long was due to a comedy of errors and omissions on the part […]

Regulators Maintain Perfect Record Of Incompetence – Massive Fraud At Peregrine Financial Goes Undetected

What is the point of having numerous regulatory agencies if they can’t detect blatant fraud despite numerous red flag warnings? Banking regulators turned a blind eye to absurdly reckless lending policies until the entire financial system came close to collapse in 2008. Regulators managed to convince themselves that Bernard Madoff’s $50 billion Ponzi scheme was […]

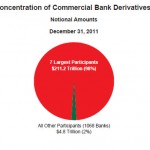

Banks Amass $211 Trillion In Derivatives, JP Morgan Loses $2 Billion And Volcher Rule Debates Continue

The goal of the Volcker Rule, which became law under the Dodd-Frank Act was to restrict speculative trading activity in risky derivatives by the Too Big To Fail Banks. The ban on proprietary bank trading was proposed by former Federal Reserve Chairman Paul Volcker who believed that one of the primary causes of the 2008 […]

Billon Dollar Bank Failure Caused By “Massive Bank Fraud” At Bank of the Commonwealth

Four years after the start of the banking crisis, federal investigators are proving what many Americans have long suspected – the root cause of many banking failures was due to fraud. The Office of the Special Inspector General for The Troubled Asset Relief Program (SIGTARP) announced last week that a massive $41 million bank fraud […]

Exponential Increase In Lending Regulations Impede Bank Lending, Provide Lifetime Employment To Government Regulators

Has the exponential increase in lending regulations since 2008 contributed to the worst economic decline since the Depression of the 1930’s? Government “solutions” to problems have a long history of failure. In addition, the unanticipated consequences of government “solutions” often result in a plethora of new problems worse than the original ones the government was […]

Bank Of America, Hated By Many, Could Make Some People Rich In 2012

During 2011, some of the smartest investment pros in the world bet heavily on Bank of America and lost big as the stock price collapsed. Concerns over the looming collapse of the European banking system sent U.S bank stocks into a tailspin as panicked investors sold. From a price of $15 in January 2011 the […]