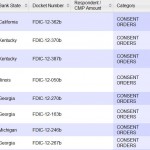

The continuing recovery of the U.S. banking industry means less work for the agency primarily responsible for the safety and soundness of the nation’s banks and savings associations. Due to the decline in banking failures and resolution receivables, the FDIC announced today that their operating budget for 2014 will decline by 10.9% to $2.39 billion. […]

FDIC Slashes Operating Budget By 11% Citing Recovery In Banking Industry

Fed Says Largest Banks Would Lose Half Trillion Dollars Under Adverse Economic Conditions

Based on the results of the Federal Reserve’s stress tests, the nation’s 18 largest banks would collectively lose a massive $462 billion under an extremely adverse hypothetical economic scenario. Reflecting the severity of the stress scenario–which includes a peak unemployment rate of 12.1 percent, a drop in equity prices of more than 50 percent, a […]

Freddie Mac Stock Jumps On Earnings – What’s Next For Shareholders?

Freddie Mac (FMCC), the government sponsored agency that backs mortgage loans for millions of American home buyers reported all time record annual profit of $11 billion for 2012. Freddie Mac has been in the black now for five consecutive quarters as the housing market improves and loan delinquencies decrease. Freddie Mac has been operating under […]

Bank “Stress Tests” Results Due In March – Don’t Expect Anyone To Fail

Under the Dodd-Frank Act, the Federal Reserve is required to conduct stress tests which are forward-looking exercises to determine whether large institutions have sufficient capital to absorb large losses and support operations under severely adverse economic conditions. The supervisory stress tests include examining capital ratios, revenue and the size of potential losses. The Federal Reserve […]

FHA Reverse Mortgage Losses Of $28 Billion – Profits For Banks, Disaster For Borrowers and Taxpayers

Reverse mortgages have become the new minefield in government sponsored mortgage lending. According to an independent estimate done for HUD, losses could exceed $28 billion through 2019. To put that figure into perspective, total losses to the FDIC Deposit Insurance Fund for the 51 banking failures of 2012 total only $2.5 billion. The good news […]

Mortgage Borrowers Pay Thousands In Excess Fees Due To Complex Bank Pricing

Few people wonder if they got the best price on that newly purchased 65” HDTV. Transparency in retail pricing through technological advances has enabled consumers to quickly locate the retailer selling a product at the lowest cost. A few quick clicks on the web or the use of price comparisons apps such as Amazon’s “Price […]

Regulators and Government Activism Are Prolonging The Housing Crisis

Banks never seem to learn as they lurch from one lending crisis to the next. In the early 1970’s the largest banks in the country lent recklessly to Latin American countries under the theory that sovereign nations would not default. The ensuing Latin American debt crisis and sovereign defaults shattered that complacent theory and many […]

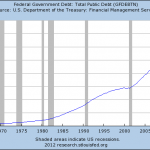

Secret Government Plans For Economic Collapse Revealed – Five Years Later Still At The Abyss

With the banking industry still in fragile condition, it is not surprising that the government has been making secret plans to deal with an economic collapse. It is a chilling thought to realize that five years since the world economy faced total collapse, we are still perched on the financial abyss. In an exclusive report, […]

Banks Planning Massive Job Cuts – Old Business Models No Longer Work

Although top management at the big banks is doing just fine, things are going to get a lot tougher for the average bank employee. In an interview with Bloomberg TV, Meredith Whitney says the banking industry will slash 50,000 employees from the payrolls due to declining margins and increased regulations. “I think the industry goes […]